Global investment activities have strongly increased since the financial and economic crisis in 2008/2009. In many places, however, investments have not regained pre-crisis levels – and worldwide investments are actually expected to decrease in the year 2015.

Investments: Painful setback

The world economy is markedly reducing its pace this year. The major emerging economies in particular have scaled back their growth expectations. Economic experts for China are now counting on an economic output increase of only 6.8 per cent this year – after having forecast 7.1 per cent in the autumn of 2014. For Brazil, the prognosis has changed to a negative 3 per cent – as opposed to the increase of 1.4 per cent that was predicted a year ago.

With the weakening of the global economy, private companies and governments in many countries are spending less in such areas as expanding production capacity or building new roads.

Based on data from the International Monetary Fund, investments in newly industrialised and emerging economies will decrease by nearly 300 billion dollars in 2015, compared to the previous year, bringing their investments down to 9.3 trillion dollars. This is still a strong figure, though, considering that the total investments in these countries in 2002 were just at 1.7 trillion dollars. An almost uninterrupted investment boom has taken place since then, which only just showed signs of weakening in 2014.

What is considerably more negative is the current investment trend in the advanced economies:

In the industrialised countries, the total domestic gross investments of nearly 9.8 trillion dollars in 2014 will decrease to 9.2 trillion dollars this year.

The investment level registered at the beginning of the 2000s would remain more than doubled; however, it still would not achieve the record level of nearly 9.9 trillion dollars that was reached in 2008, prior to the financial and economic crisis.

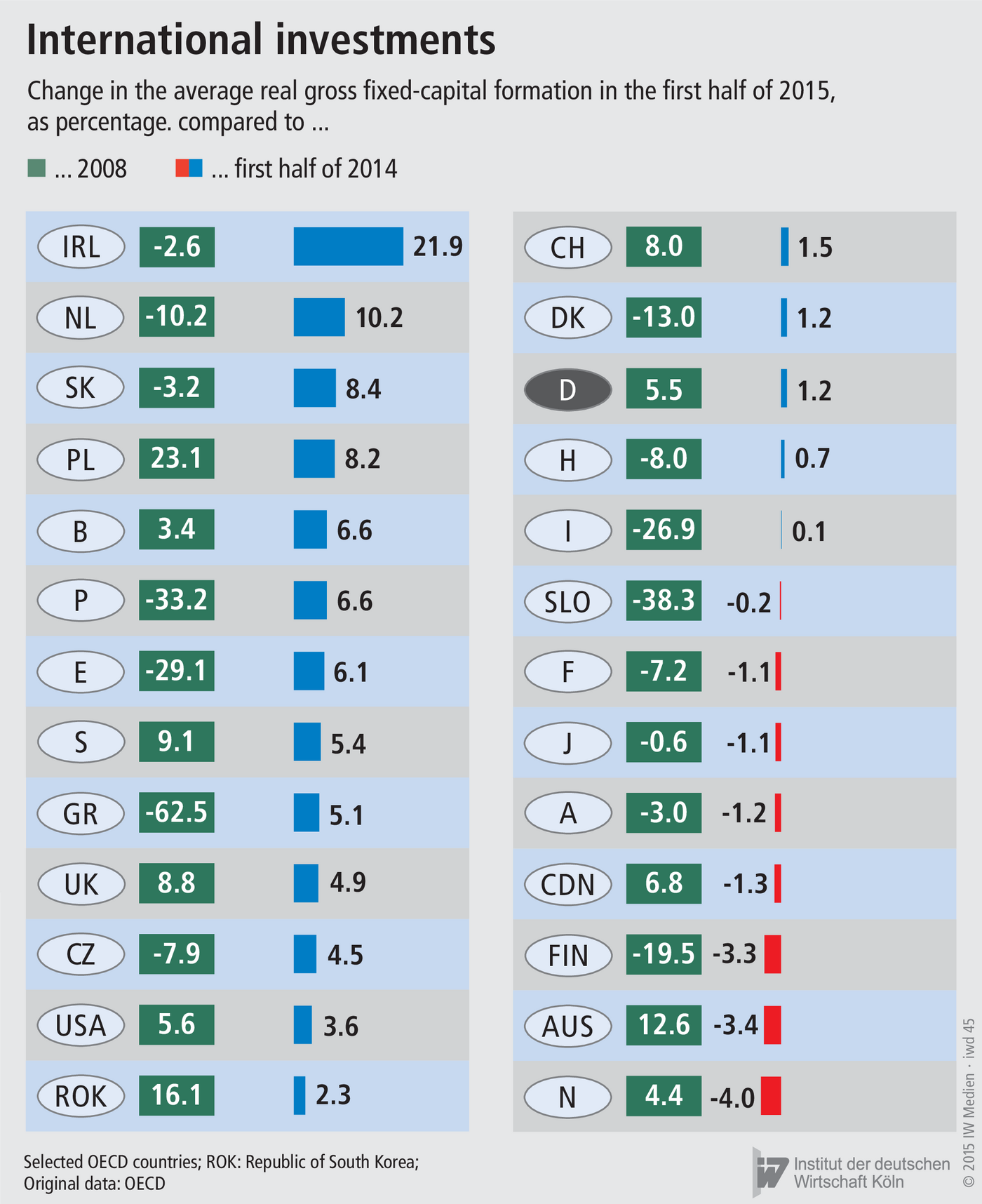

Nevertheless, recent figures show the development in the individual countries as having been quite varied (see chart). France, Japan and Austria, for example, have to bear negative figures, while the investments in Ireland and the Netherlands have seen double-digit growth. By way of comparison:

In Germany, gross fixed-capital formation during the first half of 2015, adjusted for price changes, was only 1.2 per cent higher than the same period of the previous year.

The worldwide development of investments is of particular relevance for the German economy due to its strong orientation towards the production and export of capital goods. Approximately one-seventh of the macroeconomic gross value is apportioned to the capital goods industries – more than in almost any other industrialised country. Thus, if the demand for global capital goods decreases, this will create a noticeable burden on the local economy.

Wachstumschancengesetz: Investitionen fallen nur sechs Milliarden Euro höher aus

Am Freitag entscheidet der Bundesrat über das Wachstumschancengesetz. Die abgespeckte Version dürfte die Wirtschaft nur geringfügig ankurbeln. Bis Ende des Jahrzehnts werden inflationsbereinigt sechs Milliarden Euro an zusätzlichen Investitionen ausgelöst, ...

IW

Direktinvestitionen: Hohe Abflüsse deuten auf Deindustrialisierung hin

So wenig wie lange nicht haben ausländische Unternehmen im vergangenen Jahr in Deutschland investiert, zeigt eine neue Studie des Instituts der deutschen Wirtschaft (IW). Auch die deutschen Unternehmen expandieren lieber in der EU.

IW