Fair allocation of taxing rights remains a challenge. Although there have been substantial changes in the area of International and EU-taxation due to the OECD/G20 BEPS Project, the increasing importance of the Digital Economy demands a modification of current tax rules. To prevent multilateral measures like the implementation of Digital Taxes, there is broad consensus, that the goal must be a global answer by the end of 2020. The Inclusive Framework of the OECD is working on that solution and developed Pillar 1 and 2.

online conference: Taxing the digital economy – is a global solution the answer?

Fair allocation of taxing rights remains a challenge. Although there have been substantial changes in the area of International and EU-taxation due to the OECD/G20 BEPS Project, the increasing importance of the Digital Economy demands a modification of current tax rules. To prevent multilateral measures like the implementation of Digital Taxes, there is broad consensus, that the goal must be a global answer by the end of 2020. The Inclusive Framework of the OECD is working on that solution and developed Pillar 1 and 2.

In this online conference, we discuss with our speakers and over 150 participants:

What are the purpose and the scope of the two pillars? What is the state of play of the negotiations? How could an EU-solution look like?

Programme:

16:00 h Welcome and Introduction

16:10 h Impulse by Martin Kreienbaum, Director General of International Taxation for the German Federal Ministry of Finance

16:25 h Panel Debate with

- Martin Beznoska, Economist, German Economic Institute (Institut der deutschen Wirtschaft, IW, Cologne)

- Martin Kreienbaum, Director General of International Taxation, German Federal Ministry of Finance

- Christian Borggreen, Vice President Computer & Communications Industry Association (CCIA Europe)

- Benjamin Angel, Director for direct taxation, tax coordination, economic analysis and evaluation, COM, DG TAXUD

…and moderated by Sandra Parthie, German Economic Institute (IW, Brussels)

17:00 h Q&A opportunity via Chat

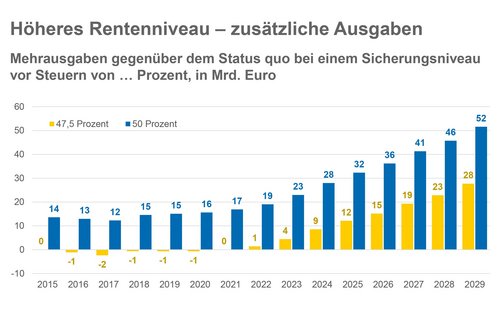

Reform der Alterssicherung im demografischen Wandel: Aufgaben für die nächste Legislaturperiode

Das Jahr 2017 steht im Zeichen der Bundestagswahl, deren Ausgang auch für die Alterssicherung richtungsweisend sein kann. Denn die nächste Legislaturperiode wird die letzte sein, bevor die Baby-Boomer nach und nach in den Ruhestand wechseln. Noch besteht die ...

IW

Der Investitionsstandort D vor strukturellen Veränderungen

Die deutsche Volkswirtschaft hat sich in den vergangenen Jahren außerordentlich stabil entwickelt. Für die nähere Zukunft stellen sich jedoch Herausforderungen, die nicht früh genug angegangen werden können: Die demografische Entwicklung führt zwar nicht zu ...

IW