The German economy is operating profitably in foreign trade. But contrary to popular belief, the current account surplus does not adversely affect the European countries impacted by the financial crisis. Indeed, the economic ascent of the newly industrialised countries has resulted in especially great demand for products from Germany’s capital goods industry.

Current account: Surplus is no ground for sanctions

Researchers predict that the German economy will record a foreign trade surplus for 2016. This would again afford Germany a leading position in international rankings; the most recent figures for Europe showed only the Netherlands as ranking above Germany (see chart).

Based on the average for the years 2013 to 2015, Germany achieved the second-highest current account surplus of all Eurozone countries, at 7.5 per cent of GDP.

In the wake of the European debt crisis, the EU introduced the Macroeconomic Imbalances Procedure (MIP). Among other things, this procedure involves Brussels more closely monitoring countries that have achieved a positive current account balance of more than 6 per cent of their economic output over the course of three years, and the possibility of measures being taken to counter economic imbalances. In the worst case, the countries may face economic sanctions. This would be grist to the mill for those who accuse the German economy of attaining commercial success at the expense of the weaker Eurozone countries.

But this accusation is unwarranted. Indeed, German surpluses are predominantly attributable to the efforts of newly industrialised and emerging economies to achieve an economic comeback since the turn of the millennium. In the two decades before then, the economy in those countries was growing at the same pace as in the industrialised countries. Since that time, the adjusted GDP has grown by 28 per cent in the wealthier countries, but by 135 per cent in the newly industrialised and emerging economies.

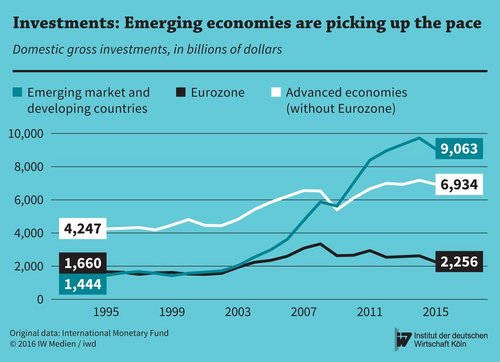

As a result, the latter countries reported an investment boom that continued until just recently (see chart).

Gross investments in the newly industrialised and emerging economies reached a record 9.7 trillion dollars in 2014 – more than six times the amount reported in the year 2000.

This positive demand shock has benefited the German economy more strongly than many other Eurozone countries. While the production of investment goods in Germany contributed some 14 per cent of the overall gross value in the year 2008, for example, the figure in France was below 6 per cent.

This enabled German companies to generate high surpluses with investment goods during the 2008 investment boom, especially in foreign trade – with surpluses at the time reaching nearly 340 billion dollars, or 9 per cent of GDP. These surpluses were not, however, linked to correspondingly high deficits in the European countries affected by the financial crisis. Greece, for instance, only recorded a deficit of 25 billion dollars in the same year in its trade of machines, production equipment and transportation equipment with all countries.

Thus, the German current account surpluses are more a reflection of the increase in production capacity in the countries outside the Eurozone.

If the EU were now to “penalise” the German economy for its commercial success, this would not benefit the European countries affected by the financial crisis – quite the contrary: if the German investment goods industry were weakened, the industry’s suppliers in the other Eurozone countries would likewise suffer.

Furthermore, the end of Germany’s surpluses could come sooner than imagined. Investments declined globally in 2015; in fact, in the newly industrialised and emerging economies, investments declined by more than 650 billion dollars compared to the year 2014. If this trend continues, it will also impact Germany’s current account balance.

More on the topic

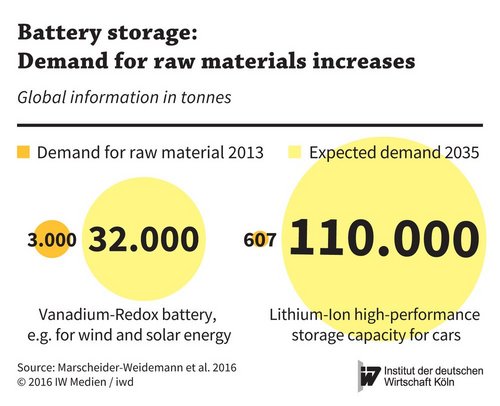

German Energy turn-around – Energiewende: Electricity looking for storage

Battery storage could go mainstream with growing shares of power produced from wind and sun and electric cars becoming more common in the streets. A rapid growth of the role of rechargeable batteries would, however, also lead to a significantly higher demand ...

IW

EU Cohesion Policy: Focusing on what is important

For decades now the EU has constantly been broadening its policy to promote economic and social cohesion. But all spending is now under scrutiny, and not only because they are about to lose a key net contributor in the form of the UK. A recent IW study reveals ...

IW