The rouble’s exchange rate devaluation against the US-Dollar helped Russia to cope with the current oil price crash. Even a crude oil price of only 40 US-Dollar would not trigger irresolvable problems for president Putin – he could still finance his imports.

The Russian Paradoxon

Additional crude oil output due to skyrocketing fracking activity in the US led to a more than 50 percent oil price slump with a barrel of crude oil worth no more than 50 US-Dollar. Although the oil price slightly recovered recently – currently a barrel crude oil sells at 65 US-Dollar – several oil price exporting countries face severe problems when trying to meet their liabilities.

In fact, things are different in Russia: Oil price consumption in general is considered to be relatively inelastic – crude oil consumption varies little over increasing or decreasing prices. Since crude oil transactions are settled in US-Dollar, Russia only gains half the Dollar value for its oil exports. However, due to a 50 percent exchange rate devaluation against the US-Dollar caused by the Ukrainian crisis, Putin gains the same amount of Russian roubles as six month ago. Finally, Russia can still finance its domestic government spending from crude oil revenues.

Importing foreign goods, in contrast, increased in price significantly. For Russian consumers it became comparatively cheaper to substitute imports with domestic products – “Made in EU” became substantially more expensive.

This process is reinforced by export restrictions and sanctions decreed by western governments. In the end the situation results in a strong stimulation of the current account – being defined as exports minus imports.

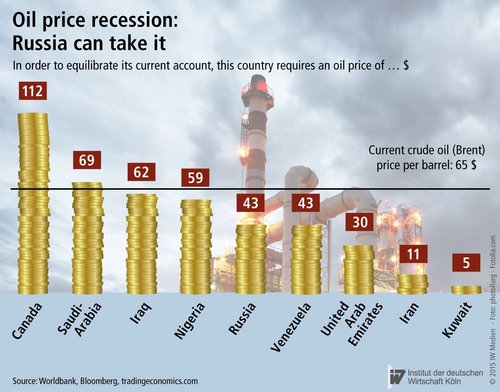

Even if the oil price declined further, the Russian current account would still be positive. This is what the Cologne Institute for Economic Research’s simulations point to (see figure). Due to missing data, the author has to imply constant foreign trade including oil exports since 2013 – a conservative assumption: At the current exchange rate, Russia would end up with an equilibrated current account at a break-even crude oil price of only 43 US-Dollar.

In reality, this threshold value is expected to be even lower as the currency devaluation drives exports while decelerating imports.

By and large, several OPEC countries can cope with the oil price recession. Kuwait, for example, evens out its current account at an oil price of only 5 US-Dollar per barrel. This is due to a massive current account surplus – Kuwait exports 43 percent of its GDP with crude oil only.

Saudi Arabia, on the other hand, requires a break-even price of 70 US-Dollar. In the end this is caused by the Saudi Arabian central bank’s fixed exchange rate regime: The Saudi Riyal did not devalue during the entire oil price slump.

More on the topic

Climate Clubs as a Lightning Rod for Tensions in Trade and Industrial Competitiveness

The Paris Agreement has established a transformative paradigm. While this transformation will create winners and losers, it now seems increasingly clear that overall, there are tremendous opportunities.

IW

German Industry's Options for a Secure Supply of Raw Materials

In recent years German industry has seen a rise in the risks attached to its procurement of raw materials.

IW