Since 1990, the world’s third-largest economy has been in a state of emergency. Japan’s economy is no longer growing, the government debt is exorbitant, and yet the country has a very low rate of unemployment and a strong credit rating. The explanations for this phenomenon diverge considerably.

Stagnation or equilibrium?

The year 1990 saw the burst of a giant financial and real estate bubble in Japan. The Nikkei index best reflects what the country has gone through since that time: Before the crash, the leading index of the Tokyo stock market peaked around 40,000 points. Today – a full quarter of a century later – it stands at a meagre 16,600 points.

The two efforts to explain Japan’s economic trend since 1990 are vastly different:

1. Japan is caught up in a permanent crisis. Real estate prices have hardly recovered since the burst of the real estate bubble; rather, they seem to have stagnated. Moreover, Japan’s commercial banks are left with a mountain of nonperforming loans and are so deep in debt that they are hardly able to lend any more money. Consequently, Japan is lacking both in business investments and in private consumption. The result:

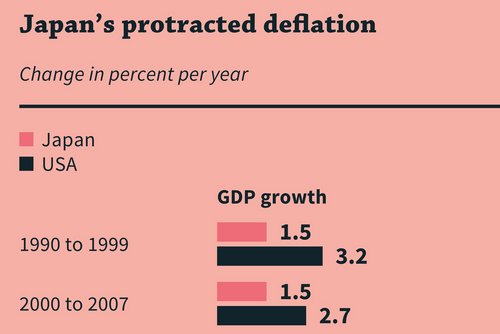

From 1990 to 2007, the economy grew by a scant 1.5 per cent per year, on average; and since 2008, annual growth has been a mere 0.1 per cent.

That’s why Japan’s economic policy has repeatedly applied extreme measures. The Bank of Japan, which was tied to the directives of the national treasury until 1998, set its hope in a policy of low interest rates from early 1995 until approximately three years ago – but without any notable success.

This was followed by Prime Minister Abe’s radical budget reductions – which have come to be referred to as Abenomics. The measure essentially consisted of an attempt to boost the economy by means of an expansive fiscal and monetary policy – namely, through debt-financed stimulus packages worth billions – with the aim of simultaneously increasing the rate of inflation by at least 2 per cent in order to reverse the trend of deflation.

But this effort also fell flat. The country remained trapped – as it still does – in a spiral of ever-increasing debt, a stagnating economy and falling prices.

Japan’s government debt has now reached over 200 per cent of its gross domestic product – which is a good 40 per cent higher than Greece’s debt was before its first cut.

However, since Japan’s government bonds still have a very good credit rating, a second interpretation of the country’s situation is making the rounds:

2. Japan’s stagnation is a result of its demographic development. For one, the country has the world’s oldest population; for another, its total population has been decreasing by an average of 0.1 per cent annually since 2008. Such a constellation leaves little room for growth, according to this second line of argumentation.

Yet a look at the GDP per capita reveals that Japan does not rank much lower than the United States – whose population continues to grow year after year. And there is still another factor (see chart):

For decades, Japan has had nearly record-low unemployment rates of 3 to 4 per cent, on average.

The country’s low investment ratio and low interest rates could also been interpreted as a result of the demographic development. On the one hand, a considerably aging and dwindling population leads to lower investments based on the simple fact of declining demand. After all, if there are fewer people employed, the companies need fewer offices and machines – and, hence, fewer investments are made.

But on the other hand, every generation needs substantial savings in order to support their livelihood after retiring. In short, a high availability of capital (savings) in Japan comes head to head with a low demand for capital (investments), thus resulting in lower interest rates.

But what is happening with the considerable sums that the frugal Japanese are setting aside? For lack of alternatives, they are investing these funds in government bonds – which also explains why Japan doesn’t having financing problems, despite its extremely high debt ratio. Unlike Greece, the Japanese government is deep in debt with its own population and central bank, while its share of foreign debt is at a relatively low 4 per cent. In both the United States and the Eurozone, for example, half of their government debt is held by foreigners.

Because of Japan’s specific national characteristics, its economy is not doing so poorly, relatively speaking. If the government would now also tackle the structural reforms that are many years overdue – in particular, straightening up the banking sector and increasing the labour supply of women – then Japan could get considerably more from its economy.

More on the topic

Effects of Public Investment on Companies in Germany – Results of the IW Business Survey

Weak public investment activity in Germany has contributed to the low productivity growth of the last decades. Even maintaining the contribution to growth of state-owned capital stock at the already low level of the 1990s would have required an additional ...

IW

Reform of EU-fiscal rules: Lindner's ideas have merit

The German government's proposal to introduce a fixed limit on government spending growth for highly indebted member states in the course of the reform of the Stability and Growth Pact makes sense. Given the macroeconomic environment, such a minimum ...

IW