The European Central Bank (ECB) was right to push down interest rates to all-time lows and to use unconventional instruments when the euro debt crisis was at its peak. However, the lasting ultra-low interest rates have begun to induce financial stability risks and put savers and financial institutions under increasing pressure. Moreover, it is now the task of governments to tackle the roots of the multiple crises that cumulated in recent years by means of significant structural reforms in many policy fields.

Smooth turnaround allows for earlier exit

Many important steps have been or are being made to achieve this. Economic conditions have improved. Provided this course stays on track as is widely expected, the Cologne Institute for Economic Research (IW) proposes to start raising interest rates after mid-2015 – and thus earlier than the ECB currently envisages. In order to prevent major turbulence in the financial markets, the ECB should start to raise interest rates only by 0.01 percent on a monthly basis. The steps need to be increased when the upswing gets broader and more dynamic. Moreover, the ECB should clearly and intensively communicate the qualitative conditions which will guide its decision about the start and the further course of interest rate increases.Our proposal.

Economic growth is forecast to reach more than 1.5 percent in 2015. This expectation is underscored by improved economic sentiment indicators. For example, the OECD’s leading indicator has increased considerably since mid-2012. Although it has stagnated recently, it is still above its long-term average.Why an earlier exit?

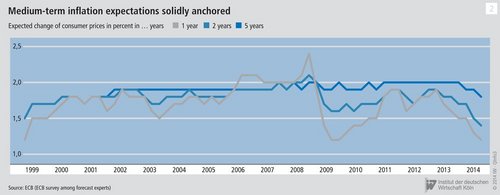

It is true that inflation in the Euro area is rather low at 0.4 percent in July 2014. However, the so-called core inflation is higher at 0.8 percent, as energy and food prices have declined considerably. What is more, only short-term inflation expectations have declined while over the medium term they remain anchored at close to 2 percent (figure).Contained deflation risk.

Many structural reforms have been implemented, particularly in the stressed countries. While more effort is still needed in this respect, the reforms taken should lay the foundation for stronger potential growth. High private debts, which could dampen growth in the near future, should be decreased at a faster but still moderate pace by using - and in some cases reforming - private insolvency regimes. The banking system in the Eurozone is also getting healthier: The “IW Bank Monitor” shows that the risk-weighted core capital ratio of the larger systemic Eurozone banks has improved from 8 percent in 2007 to 13 percent in 2013.Structural and banking reforms.

Thus, many stress indicators of the Euro banking system have improved considerably, and while problems with non-performing loans still prevail for certain banks, the outstanding Comprehensive Assessment of the ECB will lead to further capital increases. Eurozone banks should be sufficiently healthy by mid-2015 to face some very small interest rate hikes.

More on the topic

German Wage Policy between Inflation and Stagnation: Are Conflicts with the Aims of Monetary Policy Looming?

After the economic and financial crisis of 2008/9, the German labour market soon began to recover, creating scope for a comparatively expansive wage policy.

IW

A Macroeconomic Analysis of Wage-Price Spirals

The subject of this Analysis is the forms that wage-price spirals can take and how they influence macroeconomic stability and inflationary trends in Germany.

IW