Even if the debt crisis in the euro area states may not yet be over, it still doesn’t mean that the euro area needs a common budget – as many politicians are demanding. The call for such a fiscal stabilisation mechanism fails to recognise the fact that many southern European countries have, in the meantime, implemented reforms aimed at tackling the underlying causes of the crisis, thereby significantly improving the ability of these states to adapt.

EMU is more resilient than many think

The time has come around once more: as has happened every year since 2010, Greece and its international lenders are arguing over the next round of financial support worth billions. This gives Eurosceptics reason enough to once again demand dissolution of the monetary union. Others, however, are focusing on further fiscal integration. In order to financially support those countries that are struggling to cope with the effects of a recession, some politicians want to introduce a common budget for the euro area.

At first glance this idea appears to be at least worth debate. In fact, members of a currency union no longer have the option of dealing with economic problems by devaluing their currencies or lowering their interest rates. They are therefore lacking two important adjustment mechanisms.

Adjustment mechanisms are effective

However, apart from the fact that European financial supervision – unlike monetary policy – is perfectly capable of operating on a country-specific basis, alternative adjustment mechanisms have been significantly improved by structural reforms. From the very beginning, detractors of EMU maintained that member states are far too divergent and would correspondingly be affected asymmetrically by economic shocks. This – fundamentally correct – diagnosis did, however, fail to consider that those crisis-stricken southern European countries have, during the course of the crisis, implemented more far-reaching reforms than their northern neighbours. This is evident in the labour market. For instance, Portugal and Greece are among those OECD countries that have deregulated their labour markets to the greatest degree between 2008 and 2013. Germany, on the other hand, has increased its regulatory burden and is, in this respect, less well positioned than these two southern countries according to OECD estimates.

Differences have narrowed

Deregulation of the product markets has been similarly pronounced. In this respect, Portugal, Italy and Greece – three of the most crisis-stricken countries – have taken the largest reform steps. The differences between southern and northern Europe have therefore become significantly smaller.

This is essential for a monetary union to exist, because strict regulation often goes hand-in-hand with relatively rigid wages and prices, therefore weakening the effect of this key adjustment mechanism.

Wage and price flexibility. If a crisis-stricken country is no longer able to devalue its currency, it is forced to make adjustments somewhere else. Prices must be reduced – or at least only allowed to increase at a significantly slower rate – and this applies to goods, services and labour.

In contrast to the commonly assumed position, wage flexibility in the euro area was already relatively high before the crisis took hold. Between 2008 and 2011, during the height of the global financial crisis, wages had reacted to the increase in unemployment in a similarly flexible manner as in the US, which is often cited as a role model for Europe with the US-Dollar currency union. Micro data from household surveys provides evidence of the large degree of wage flexibility in southern European countries and particularly in Portugal, for example (chart):During crisis year 2011, 79 percent of Portuguese full-time workers had to accept real cuts in their wages.

The structural reforms will further strengthen this adjustment mechanism in southern Europe, while reforms to the wage setting systems are also contributing to the recovery in job creation and the restoration of competitiveness.

Workforce mobility: It is also possible for the employment to adapt to a crisis situation, when unemployed workers from a country in recession search for a temporary job in another member state of the currency area. While it is true that longer-term migratory movements in the euro area remain significantly lower than in the USA – as a result of language, cultural and legal hurdles – the functionality of a monetary union is primarily dependent upon short-term mobility. In fact, short term labour mobility, as confirmed by studies, was at a similar level in the euro area during the recent crisis as in the USA.

This was primarily due to the mobility of those immigrants who are not originally from the euro area, but come from Central and Eastern Europe, for example. But it is also true that workers are now more willing to leave their native euro area countries.

Financial integration: Improved cross-border financial integration also helps cushion economic shocks in the individual member states of a currency union.

This works when foreign investors commit to a country over the longer term, because they will participate in the crisis through falls in share prices on the stock markets, for example. Foreign creditors may also issue loans during crisis times which help maintain the level of consumption in that country, even if incomes there collapse temporarily.

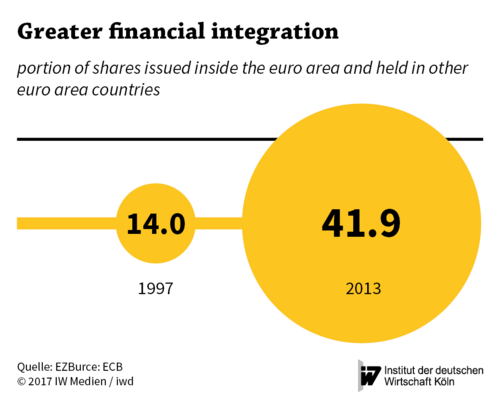

Admittedly, key aspects of this adjustment mechanism failed during the European debt crisis – evident mainly in the short-term withdrawal of interbank lending. Nevertheless, longer-term financial integration in the euro area has now become more pronounced than has been generally assumed (chart):

For example, the proportion of shares issued inside the euro area and held in other euro area countries has increased from 14 percent in 1997 to 42 percent in 2013.

Regardless of how severe the consequences may have been – and in some cases still are – the crisis ultimately also offered an opportunity. It has generated a pressure which was patently needed to relieve the functional problems of the monetary union. Once the legacy problems of the recent crisis are sufficiently solved, there are many indications that the euro area is sustainable, even without further fiscal integration.

Core statements in brief:

- Portugal and Greece are among the three OECD countries that have deregulated their labour and product markets most actively between 2008 and 2013.

- Adjustments in labour and product markets have caused the differences between southern and northern Europe to reduce significantly.

- Important adjustment mechanisms in euro area countries (wage flexibility, labour mobility, and financial risk sharing) are significantly better than often recognised – and will make the euro area more resilient in the future.

More on the topic

Not so Different?: Dependency of the German and Italian Industry on China Intermediate Inputs

On average the German and Italian industry display a very similar intermediate input dependence on China, whether accounting for domestic inputs or not.

IW

China’s Trade Surplus – Implications for the World and for Europe

China’s merchandise trade surplus has reached an all-time high and is likely to rise further. A key driver appears to be a policy push to further bolster Chinese domestic manufacturing production, implying the danger of significant overcapacities.

IW