The signs are clear: In the event of an electoral victory, Prime Minister Cameron’s government plans to begin renegotiating the United Kingdom’s relationship with the European Union in 2015 and to hold a referendum in 2017. The possibility that the UK may leave the EU can no longer be ruled out.

No man is an island

Most of the British people are favourably inclined toward the European single market, but they view the EU’s extensive powers in other areas with scepticism, if not outright disapproval. As a result, many politicians want a new settlement of the relationship between the UK and the EU.

Their goals, within the existing treaties, include the further liberalisation of the flow of services within the EU, a reform of agricultural policy and a reduction in the administrative costs of the European Commission and the European Parliament. Critics also call for returning authority over labour and social law to the member states. In addition, they favour requiring a unanimous vote of the European Council to pass laws affecting fundamental national interests. However, it is unlikely that the UK’s demands will be met, since this might result in labour and social regulations that differ from one EU country to another, distorting competition within the single market.

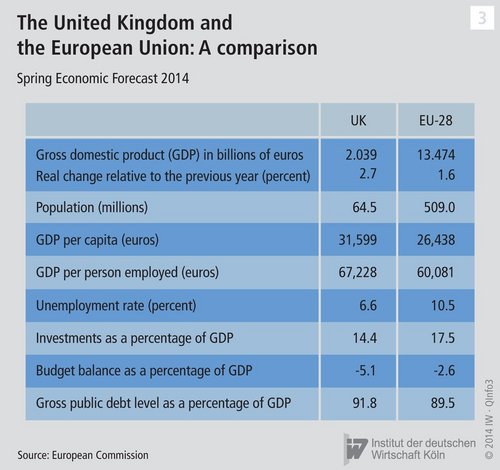

If the British people were actually to vote to leave the EU, neither side would remain unaffected – not least because of the UK’s economic importance (see table). With a gross domestic product of over two thousand bilion euros, the United Kingdom accounts for more than 15 percent of the EU’s total GDP. At this point, it is difficult to predict what leaving the EU would mean for the UK’s economy. In a recent study, British economists predicted that the country’s GDP would decline by between 1.2 and 9.5 percent, depending on the underlying assumptions.

In any event, it is clear that the UK would lose its free access to the European single market. This would make it less attractive for investment by foreign businesses, which would particularly affect the financial sector. It would also be more difficult for British companies to be part of EU-wide supply chains, and this would have especially severe consequences for the automobile industry. The remaining EU countries would have a great deal to lose as well; their companies could expect sales to the UK to decline.

What’s more, the United Kingdom would not be autonomous even if it did leave the European Union. Maintaining any relationship with the EU at all, in an effort to reap as many as possible of the economic benefits that membership provides, would require continuing to abide by many EU regulations. The UK would be relegated to the political sidelines, however, since it would no longer be able to play a role in shaping those regulations.

More on the topic

Current account: Surplus is no ground for sanctions

The German economy is operating profitably in foreign trade. But contrary to popular belief, the current account surplus does not adversely affect the European countries impacted by the financial crisis. Indeed, the economic ascent of the newly industrialised ...

IW

German Energy turn-around – Energiewende: Electricity looking for storage

Battery storage could go mainstream with growing shares of power produced from wind and sun and electric cars becoming more common in the streets. A rapid growth of the role of rechargeable batteries would, however, also lead to a significantly higher demand ...

IW