Several banks have issued so-called CoCo bonds in order to strengthen their capital base. But these bonds can put pressure on banks once confidence is disturbed.

CoCos: Turning sour

The problems Deutsche Bank is currently facing have pushed banks and financial market instruments into the public focus again. When a bank, for example, intents to supply loans to business and households, it has to finance these loans with equity capital – either by issuing stocks or by retaining earnings – and with debt capital, for example by issuing bonds.

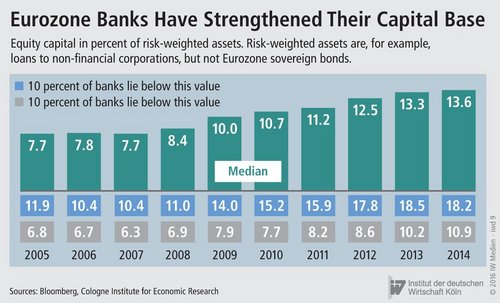

Because bank capital requirements regulation was tightened after the financial crisis, Eurozone banks have had to strengthen their equity capital base (figure):

The Euro area banks’ risk-weighted equity capital ratios increased from an average of 8 percent to nearly 14 percent.

But banks have a hard time in attracting additional stock investors in an uncertain economic environment. This is because stock investors will participate in profit sharing during peaks, but also share the banks’ losses during valleys. Borrowers, like bond investors, receive a fixed payment and only participate in losses when a bank experiences serious trouble and is unable to pay its creditors.

In order to strengthen their capital base, banks have recently discovered special bonds: contingent convertible bonds – CoCos. These bonds resemble equity capital from a regulatory viewpoint, but are considered debt capital in terms of taxation, meaning that interest payments are tax deductible.

The bonds’ special feature is that CoCos can be converted to stocks, turning creditors into owners when the bank’s capital falls below a certain threshold. Therefore, creditors possibly bear losses. In return, CoCo-bondholders receive high yields to compensate for the risk.

Most recently, the prices of CoCos have fallen – likely because capital market investors expect the risk of a conversion to equity capital to materialize. Such a loss of confidence will be problematic for banks: Even if banks have a robust capital structure, the decline in confidence could lead CoCo investors to withdraw their capital at maturity of the bonds – thereby worsening the banks financing conditions.

More on the topic

Energy consumption: Targets threaten efficiency of EU climate and decarbonization policies

Increasingly stringent energy consumption targets for the year 2030 flanked by national energy efficiency targets are about to being agreed at the EU level. A study by the German Economic Institute (IW) shows that these targets when applied to ETS-sectors, ...

IW

(Un-)Fair taxation of the digital economy

The EU would neglect its responsibility for the mismatch of tax policies among member states by implementing a taxation of the digital economy. It would translate into a tax increase for a specific group of companies, which would make the classification of ...

IW