Germans tend to use their credit or debit cards much less for paying for their shopping than most other EU citizens. Part of the reason is that they don’t like to pay digitally but another part is that they simply cannot.

Loving cash

Germany used to be a frontrunner for innovations in the payment sector but is now in danger of losing ground. Thus was a recent criticism by Boston Consulting Group, a global consultancy, in a recent report with regard to the reluctant use of electronic payment options by the Germans. But those electronic payments are the means of the future, says i.e. Deutsche Bank CEO John Cryan. He even predicted at the Davos Forumin 2016 that within ten years, cash won’t even be around anymore because it simply is too “frightfully inefficient”.

But those forecasting the death of cash meet strong resistance by German shoppers. Even as recently as 2014 eight out of ten payments were conducted exchanges coins and bank notes in Germany. Almost nowhere else in Europe the credit and debit cards are used so little:

In 2016 every German used his or her plastic money on average 49 times. Danes and Swedes on the other hand reached for it more than 300 times.

Finns, Britons, Dutch, Estonians and Luxembourger still used the electronic payment terminals more than 200 times. Only Bulgarians, Romanians, Greeks and Italians are using plastic cards less than Germans.

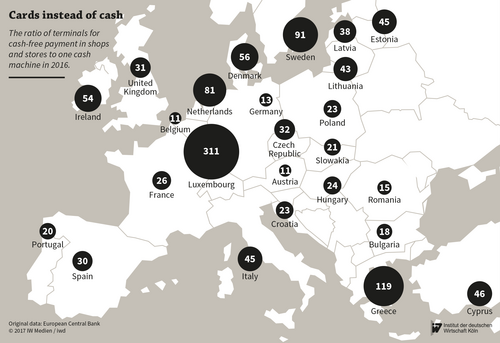

The various national preferences are also linked to the availability and spread of cash machines as well as the density of shops accepting cash-free payments. (Graph)

While in Germany in 2016 the ratio is one cash machine to 13 terminals for cash-free payment in shops and stores, it is 91 in Sweden and even 311 in Luxembourg.

In many countries this is a mirror image: few cash machines equals many options for cash-free payments, like for instance in Scandinavia. In Germany however the situation is reversed: 1.000 cash machines per 1 million inhabitants are, compared with the EU average, a lot, just 14.000 retailers with debit card terminals on the other hand not much.

The choice the Germans make on whether to use cash or not usually depends on how much of it they have at the ready and on the amount that needs to be paid. Those are the findings of a survey by German Bundesbank from 2014. It also found that 2/3 of Germans believe that they can better control their spending when they see how the wallet get emptier and emptier. Regarding the debit card payments, 71% of those surveyed value the easy use. The increase of electronic payments in Germany has one further reason: the internet. As online shopping, where cash payments are not even an option anymore, intensifies special internet payment means such as Paypal dominate with a share of 41 percent of the turnover, followed by bank transfers (23%) and credit cards (18%).

Paypal and Co might be in line for a further boost when the European payment services directive (PSD2) enters into force in Germany in 2018. The directive will provide so called Fintechs - thus companies outside the banking sector, who offer payment services – with access to account details, if a bank’s costumer agrees to it. Only the data necessary for the specific payment operation will be made available and it is also ensured that they do not end up in the wrong hands.

More on the topic

Energy consumption: Targets threaten efficiency of EU climate and decarbonization policies

Increasingly stringent energy consumption targets for the year 2030 flanked by national energy efficiency targets are about to being agreed at the EU level. A study by the German Economic Institute (IW) shows that these targets when applied to ETS-sectors, ...

IW

(Un-)Fair taxation of the digital economy

The EU would neglect its responsibility for the mismatch of tax policies among member states by implementing a taxation of the digital economy. It would translate into a tax increase for a specific group of companies, which would make the classification of ...

IW