The COVID-19 pandemic has worsened the financial positions of many companies. For the next months, a wave of insolvencies, a zombification caused by rescue measures or a debt deleveraging are on the table. Which of the three scenarios will dominate, depends, however, on the efficiency of restructuring measures.

Will COVID-19 Cause Insolvencies, Zombification or Debt Deleveraging?

IW-Kurzbericht

The COVID-19 pandemic has worsened the financial positions of many companies. For the next months, a wave of insolvencies, a zombification caused by rescue measures or a debt deleveraging are on the table. Which of the three scenarios will dominate, depends, however, on the efficiency of restructuring measures.

The COVID-19 pandemic has hit the business sector, especially the tourism sector, restaurants, shops and other business which depend on physical social interactions. Many firms have already experienced a decline in their liquidity buffers and equity capital buffers and only emergency loans could prevent many pandemic-hit companies from dire financial distress. Since the pandemic and the lockdown measures have increased corporate indebtedness and at the same time worsened their creditworthiness, the corporate sector will experience three possible, not mutually exclusive scenarios: insolvencies, zombification, and debt deleveraging.

Scenario 1: Insolvencies

Fear of infections reduced the demand for goods and services in several sectors of the economy, while lockdown measures reduced the supply. Many companies did not have sufficient cash balances to pay their current costs, like rent and wages. Therefore, these companies had to increase their indebtedness in order to ensure payments. In case that the pandemic lasts too long, these companies stay indebted without sufficient revenues for paying back their loans. Companies with liquidity problems face the risk that these problems become solvency problems. Thus, it can be expected that the number of insolvencies will increase in the next months.

There are economic sectors in which companies even in normal times face higher insolvency risks than in other sectors. Risks are high in sectors with many small companies, like restaurants or shops, since smaller companies have less financial means to buffer shocks. Insolvencies are less likely in sectors with large companies with many product lines which can better diversify their business risks. Since the companies which are most affected by the pandemic and lockdown measures are restaurants, shops, hairdressers and other smaller companies, aspike in insolvencies can be expected here. But also medium-sized companies affected by the pandemic, like larger hotels or tourism agencies, could run into financial distress in the coming months. Larger companies, like aviation or shipping companies also face declining revenues but are better able to absorb the shock intourism when they have additional business lines not affected by the pandemic. The crucial point is, that most of these companies would have been profitable if the pandemic would not have occurred. These companies running into insolvency is not a cleansing effect, but a destruction of organizational capital. That is why rescue measures are justified.

Scenario 2: Zombification

For most companies the pandemic-induced lack of profitability is not caused by structural weaknesses, but by a short-term shock which will fade-out after the pandemic has ended. Rescue measures aim at preventing this, but at the same time they enable structurally weak companies to stay in the market for longer.

But is this a problem? Not every company that is unprofitable has to leave the market, because there is the possibility of regaining profitability by applying restructuring measures. Zombification will only occur, if companies can stay in the market without having the pres-sure to restructure in order to stay in the market. Thus, it is not the rescue measures that enable zombification, but a lack of restructuring measures and a lack of effective insolvency proceedings for those companies, which do not have viable business models or viable restructur-ing plans.

Scenario 3: Debt Deleveraging

Companies have increased their indebtedness as a re-sponse to declining revenues which could not be in-vested into profitable opportunities. Instead, these loanscould only be used for covering current costs. Thus, the balance sheets of many companies have worsened dur-ing the pandemic. In order to prevent a restricted access to finance in the future, companies have to reduce their indebtedness in order to be creditworthy in the future. Thus, they are expected to deleverage before they en-gage in new investments.

Using restructuring measures for improving the bal-ance sheet quality will result in a low investment activity. Some companies will forego investments that might be profitable under other circumstances, which might lead to competitive disadvantages. But this period of deleveraging should not be mistaken with a zombification, since the later will lead to a longer period of low productivity, while the use of restructuring measures will enhance productivity and profitability in the future.

The European Economy after COVID-19: What’s to Expect?

Most likely, the economy will experience a mixture of all three scenarios: some companies will leave the market, some unproductive firms can stay in the market be-cause of eased credit conditions, while a lot of companies have to decrease their indebtedness before they can engage in new investments.

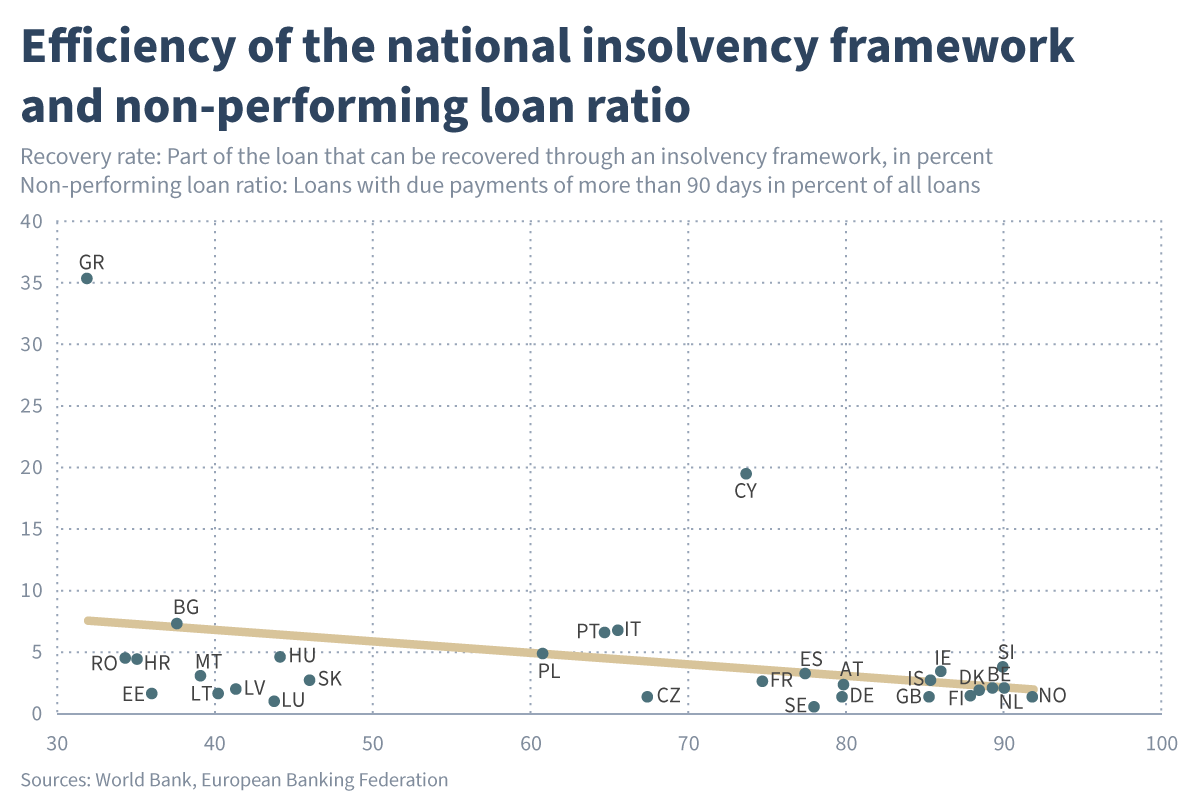

From the viewpoint of those who are analyzing companies it will be difficult in the next months to distinguish between the financially distressed companies: some are possible zombie companies and other companies are deleveraging but returning to productivity in the future. This differentiation will be much easier in countries with efficient insolvency proceedings and restructuring in-struments, like in Germany or in Finland, and much more complicated in countries with less efficient insolvency proceedings and a lack of restructuring instruments, like in Greece.

It can be expected that many of the company loans will become non-performing in the coming months. What we have seen after the Global Financial Crisis and the Banking and Sovereign Debt Crisis in the Eurozone was that the share of non-performing loans tends to be high-er in countries with inefficient insolvency systems and tends to be lower in countries with more efficient insolvency systems (see figure). The rationale behind this is that banks in countries with an insolvency framework that enables a high recovery rate will try to get their mon-ey back by resolving the creditors’ assets, while banks in countries with an insolvency framework which only allows to recover a low fraction of the potential loan loss tend to prolong the credit lines to troubled companies in the hope that these companies will become profita-ble in the future.

For the European Union it can be expected that we are back in a situation comparable to the years after the Global Financial Crisis and the Banking and Sovereign Debt Crisis, in which indebted companies deleverage, while non-performing loans on banks’ balance sheets will accumulate in countries with inefficient insolvency frameworks.

What Policy Can Do

The European Union adopted the Restructuring and Second Chance Directive last year. Preventative restructuring frameworks come at the right time because they enable the pandemic-hit companies to use restructur-ing tools to improve their balance sheets and regain creditworthiness. These frameworks support the delev-eraging process of the companies and prevent a zombification of our economies. Insolvency frameworks, in addition to that, prevent a zombification by enabling the liquidation of non-viable companies.

In market economies, non-viable companies should leave the market making room for new companies with better business models. The pandemic, however, is not a cleansing crisis because it hits viable companies in the same way as non-viable companies. The challenge for banks and investors is not only to support the recovery of the viable companies, but also to enable the market exit of non-viable companies. While monetary policy does currently a very good job in providing favorable financing conditions and supporting lending by banks to companies, bank supervisors should be aware that banks could also tend to lend to non-viable companies in order to prevent loan losses which will lead to an accumulation of non-performing loans on their balance sheets which will hinder lending to viable companies in the future. Guiding banks in reducing non-performing loans will be essential in the coming months.

Markus Demary: Will COVID-19 Cause Insolvencies – Zombification or Debt Deleveraging?

IW-Kurzbericht

More on the topic

A Macroeconomic Analysis of Wage-Price Spirals

The subject of this Analysis is the forms that wage-price spirals can take and how they influence macroeconomic stability and inflationary trends in Germany.

IW

Pharmaceutical industry: Increasing pressure on the labor market

The shortage of skilled workers poses significant challenges for pharmaceutical companies in Germany and is expected to become increasingly problematic in the context of demographic changes. Concerning Germany's positioning in the international competition ...

IW