It has now been 50 years since Apollo 11 landed on the moon. On 20 July 1969 (21 July German time), Neil Armstrong and Edwin “Buzz” Aldrin became the first people to land on the moon. It marked a decisive victory in the space race between the United States and the Soviet Union. The Apollo program was not an economic project. By today’s metrics, it cost over USD 140 billion (based on Wilford, 1969, 67). Meanwhile, aerospace is not only a government-subsidised business, but rather has also become attractive for private companies. The United States announced that it plans to send American astronauts to the moon again within the next five years (Sueddeutsche.de, 2019). Whether that will succeed is still unclear. The business community, however, is already searching for opportunities in space today.

Space Economy

IW-Kurzbericht

It has now been 50 years since Apollo 11 landed on the moon. On 20 July 1969 (21 July German time), Neil Armstrong and Edwin “Buzz” Aldrin became the first people to land on the moon. It marked a decisive victory in the space race between the United States and the Soviet Union. The Apollo program was not an economic project. By today’s metrics, it cost over USD 140 billion (based on Wilford, 1969, 67). Meanwhile, aerospace is not only a government-subsidised business, but rather has also become attractive for private companies. The United States announced that it plans to send American astronauts to the moon again within the next five years (Sueddeutsche.de, 2019). Whether that will succeed is still unclear. The business community, however, is already searching for opportunities in space today.

Opportunities for the private sector

For decades in the United States, aerospace has been an expensive project for the state and its agencies like NASA. As suppliers of technologies, private companies were part of the programmes from the beginning. For example, Boeing was involved in the development and construction of the Saturn V rockets in the sixties. In the meantime, private companies are making more use of market opportunities related to commercial and state aerospace than back then:

- as suppliers and producers of aerospace vehicles

- as suppliers and producers of satellites

- as suppliers and producers of ground-based equipment

- as handlers of rocket launches and transporters of loads into space

- as service providers and operators of satellites

- as users of satellite data and other satellite-supported services

While industrial companies have played a critical role as hardware suppliers for a long time now, there has been a shift in the distribution of roles for the handling of launches and thus the transport of loads into space in recent years. Besides the state agencies such as NASA in the United States or the ESA in Europe, various private companies are also active in the competition. For example, the company SpaceX founded by Elon Musk is now a market leader in satellite launches and is engaged by NASA for supply flights to the International Space Station (ISS) and the building of a spaceship for manned trips into space (Faz.net, 2018). However, ground-based satellite technology is also dominated by private suppliers which, for example, produce satellite dishes for television reception.

Both state institutions and private companies use satellites and offer corresponding services. Governments use espionage satellites and provide position data (GPS); television stations offer satellite transmission; telecommunications operators make satellite connections available. Satellite-supported internet connections are spreading, above all in areas with poor terrestrial or mobile infrastructure, to facilitate access to global data networks. Innovative satellite-based data can be used for data-based services. An example of this is the satellite-supported analysis of agricultural land for the farming industry. Traffic situations and infrastructure disruptions can be viewed from space; position services become more accurate and additional paths of communication are available. Space services can also contribute to the development of internet-based industrial offers and become a part of Industry 4.0.

Market development

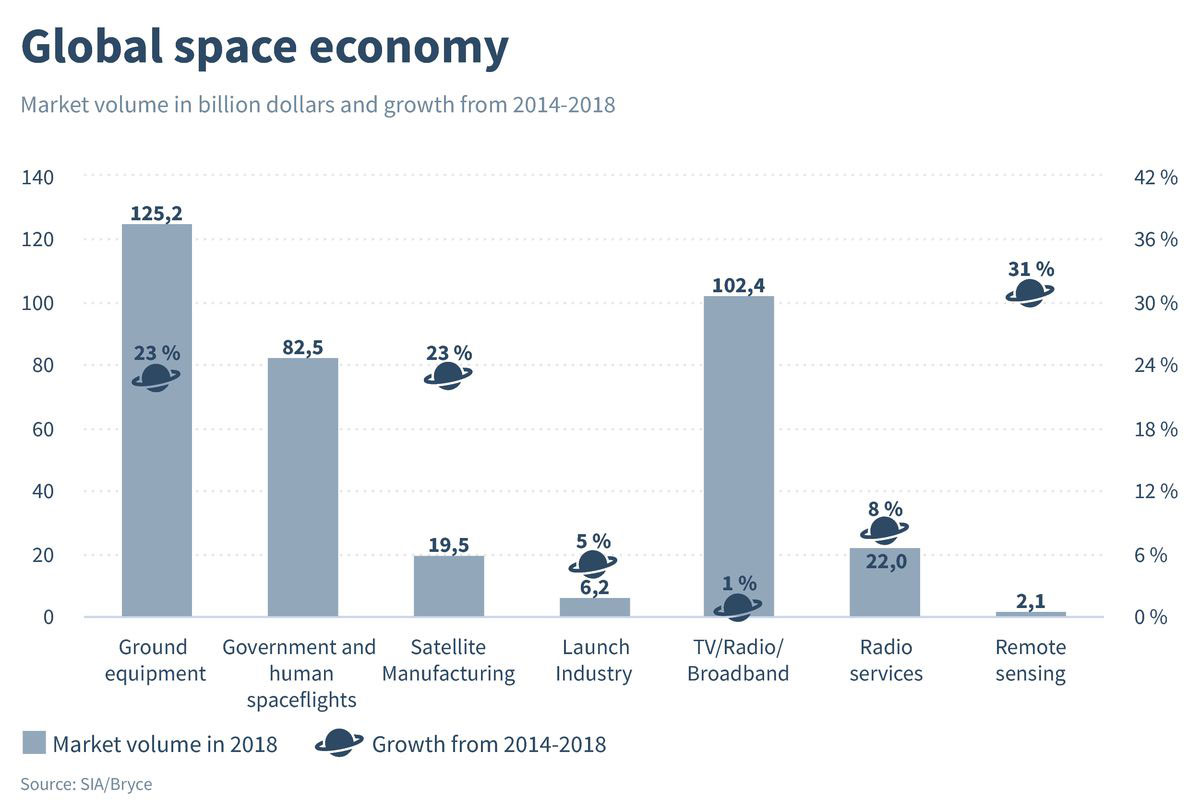

The space market is currently dominated by three major segments. The entire market accounted for a total of USD 360 billion or EUR 305 billion in 2018. Of this amount, USD 125 billion was attributable to ground-based equipment, like satellite navigation systems or receiver devices for satellite TV or broadband (see figure). The transmission of television, radio or broadband signals amounts to USD 102 billion, which is by far the most important aerospace-based commercial service. Other services play a significantly smaller role to date. Fixed or mobile radio services, including satellite phones, account for just USD 22 billion, while earth observation services such as satellite images reach just 2.1 billion. Government activities and human spaceflights, which collectively total just under USD 83 billion, are only the third-most important part of the entire space market.

In recent years, hardly any growth has been seen in the largest sub-market of satellite services – the television business – but remote sensing services have increased by around 30 per cent since 2014. In future, it is also possible to anticipate significant potential for growth here if the produced data show potential for new data-based business models. Significant increases of almost one-quarter were also seen in mobile radio services, ground equipment and satellite building. Accordingly, the number of commercial satellites has risen sharply in the last few years. Simultaneously, the use of mobile satellite phones and navigation equipment has increased substantially.

Germany, Europe and space

Alongside publicly funded aerospace in Germany, where the main focus is on involvement in activities at the International Space Station (ISS), the commercial aerospace industry is also of interest to the German economy. This goes for both component production for Ariane rockets and for satellite construction. Accordingly, the Ariane Group in Bremen, for example, builds the upper stage of the current Ariane rockets, while various companies are involved in satellite construction. But the use of satellite-based data for new business models in the context of the digital economy also offers important potential for the German industry. Both established companies and an independent start-up scene are working on new possibilities for using space technology economically, a project that goes by the name of “New Space” (SpaceTech Partners / BHO Legal, 2016). In addition, it is necessary to have not only the funding, but also close collaboration with research institutions, state aerospace institutions and other companies focused on aerospace. 50 years after the first moon landing, another step is still necessary to turn use of space into an everyday matter.

In order to facilitate this, it is necessary to use synergies. The European Union realised this and increased its expenditures for space projects in the next EU budget (2021 to 2027) to EUR 16 billion (European Commission, 2018). Of this amount, just under EUR 10 billion is budgeted alone for the European satellite navigation system Galileo and EGNOS, the supplementary programme for satellite navigation. Many other countries outside the EU are also involved in these systems.

Space cooperation inside and outside the EU not only promotes innovation, but also helps with the development of business segments and standardisation. This is a worthwhile investment in the European economy of the future.

Hubertus Bardt: Space Economy

IW-Kurzbericht

More on the topic

![[Translate to English:] Das Gebäude des Weißen Hauses in Washington, D.C. in den Vereinigten Staaten von Amerika. [Translate to English:] Das Gebäude des Weißen Hauses in Washington, D.C. in den Vereinigten Staaten von Amerika.](/fileadmin/_processed_/c/1/csm_GettyImages-2161499385_White_House_Editorial_884306add8.jpg)

Trump or Harris or ...? What Europe must prepare for

A few months before the presidential election in the USA, Donald Trump has a good chance of being re-elected. On the Democratic side, the incumbent president has withdrawn his candidacy after a long period of hesitation, while Vice President Kamala Harris is ...

IW

Competitive pressure from China for German companies

A firm survey conducted in March/April 2024 as part of the IW-Zukunftspanel among around 900 German companies from the manufacturing and industrial services sectors shows that around 350 of the companies surveyed have Chinese competitors in their markets.

IW