For years, the European Central Bank has been flooding the markets with cash in order to stimulate inflation. However, this traditional method is no longer working. One of the reasons for this is that EU citizens are hoarding cash.

The effects of monetary policy are being curbed: by cash

Key points in brief:

1. Since the collapse of the US investment bank, Lehman Brothers, the rate of inflation in the Eurozone has often fallen short of the 2 percent that the ECB has been striving for.

2. One of the reasons for the ineffectiveness of what is ultimately an ultra-expansionary monetary policy is the increase in cash holdings – a typical reaction in uncertain times.

3. If politicians are to allow the European Central Bank to move away from its zero-interest policy, what they must do, above all, is to regain the trust of companies and citizens.

The European Central Bank (ECB) is striving to keep inflation in the Eurozone at 2 percent. There is a good reason for this. If the general rate of inflation is much higher than this, incomes lose their buying power and there is a decline in the standard of living. If price increases are significantly lower, there is a risk of deflation and recession.

None of this is desirable. However, the trend has certainly been towards deflation. Since the collapse of Lehmann Brothers and the beginning of the global financial crisis in 2008, inflation has generally been too low.

In 2015, price increases in the Eurozone stayed at 0 percent and in Germany they amounted to a measly 0.3 percent.

Admittedly, in December 2016, the statisticians recorded a jump in inflation of 1.1 percent in the Eurozone and 1.7 percent in Germany. However, this was due in part at least to the increase in oil prices. Whether the December inflation figures signal a new trend for 2017 remains to be seen.

So, are zero interest rates and the ECB’s bond purchase-programme costing billions, a complete waste of time?

The point of the low interest rates was to stimulate private consumption and entrepreneurial investment. And by purchasing government bonds, the ECB flooded the markets with euros fresh off the printing press. This had led to increasing stocks of M3 – including cash in circulation, bank account balances and securities with a term of under two years. These increases have been exceeding the target of 4.5 percent since 2015. Previously, the growth in money stocks had been far lower for many years.

Cash hoarding is making life harder for the ECB

The problem is that the prices have remained utterly indifferent to the money pouring out of Frankfurt. This is partly because citizens and companies in the Eurozone are hoarding more and more cash, thereby limiting lending by the business banks and the creation of money which should result from this.

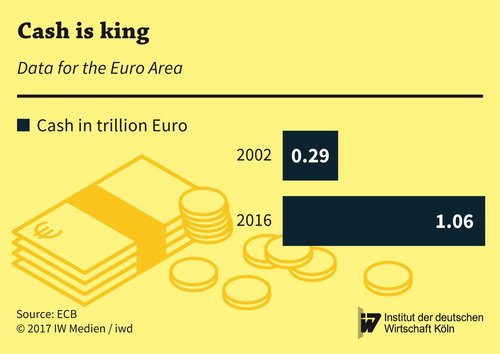

In 2015, one tenth of the entire money supply was not held in bank or savings accounts, but lingered in wallets or slumbered under mattresses.

When the Euro was introduced in 2002, the proportion of cash was only half as high, though already beginning to rise, and this was given a further impetus by the Lehman collapse.

Shifting money from long-term securities into cash, which is available at any time, is typical in crisis situations. Households and companies want to be able to react quickly. To that extent, these growing stocks of cash are a reflection of the European debt crisis.

The best policy for halting the trend towards deflation and enabling the ECB to shake off its ultra-costly monetary policy is to create trust among the market players and produce economic and political stability.

More on the topic

German Wage Policy between Inflation and Stagnation: Are Conflicts with the Aims of Monetary Policy Looming?

After the economic and financial crisis of 2008/9, the German labour market soon began to recover, creating scope for a comparatively expansive wage policy.

IW

A Macroeconomic Analysis of Wage-Price Spirals

The subject of this Analysis is the forms that wage-price spirals can take and how they influence macroeconomic stability and inflationary trends in Germany.

IW