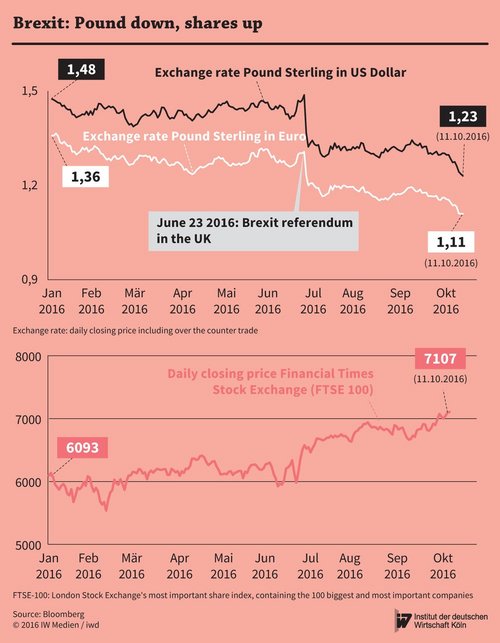

Ever since the British voted in June to leave the EU, the markets have been running wild. While the pound sterling continues losing value against the dollar and the euro, the British stock market is on its way to a new all-time high.

Out they go: and down they go

It wasn’t a Black Friday like 25 October 1929, when the New York Stock Exchange crashed after days of falling stock prices, setting off a worldwide economic crisis. It also wasn’t about share prices. Yet what happened on the exchange market in the early hours of last Friday morning, at 1:07 a.m. Central European Time, was indeed a shock: in a matter of two minutes, the pound sterling plunged 6 per cent against the dollar.

The pound fell by 10 per cent within just a few days of the Brexit vote

According to information from financial service provider Bloomberg, the bid-ask spread – that is, the difference between the purchasing and selling price – surged to 250 times its median during the past year. The exchange rate collapse can be explained by the massive excess supply of pounds sterling on the market without an immediate buyer.

Since the British currency almost completely recovered within just a few minutes, the incident was tagged as a mere “flash crash”. And yet currency dealers are still mystified as to how the event could have come about in the first place.

The pound is under immense pressure

Two explanations are being hotly debated: One possibility is that a larger sell order was inadvertently entered – known on the financial markets as a “fat-finger error”. The other possible reason is because, just three hours before the crash, the Reuters news agency reported that French President Francois Hollande was demanding that Europe take a tougher position on Brexit negotiations.

But regardless of what ultimately caused this market slide, it was aided by the fact that neither the American nor the British bankers were active at 1:07 a.m. CET. Individual players typically have a much greater impact on the market during this time of day than under normal circumstances. If an exchange rate falls below a particular threshold, automated algorithms are activated, accelerating the crash.

This is compounded by the high level of uncertainty present on the British markets since the referendum:

Within the short interval between the date of the Brexit vote – Thursday, 23 June – and the following Monday, the pound lost 10 per cent of its value against both the dollar and the euro.

Nerves have been running high since then. And the next shockwave was emitted from the Conservative Party conference during the first weekend of October. There, Prime Minister Theresa May removed any trace of doubt that the UK will indeed leave the EU; the corresponding Article 50 of the Lisbon Treaty is set to be triggered by the end of March 2017. Likewise, May made it unmistakably clear that she will follow a hard line in subsequent negotiations with the EU. “The authority of EU law will end,” said May.

Up to that time Brexit opponents, especially businesses, had still hoped for a gentle Brexit – that is, a separation in which everything would largely remain as it was, in particular their access to the European Single Market.

Brexit: Out of the EU, down with the market prices

Brexit supporters, on the other hand, are more concerned about restricting immigration – and, to this end, are obviously prepared to leave the EU customs union and accept their limited access to the European Single Market. This would, however, be a high price indeed:

Based on calculations of the British Treasury in London, without access to the Single Market, the UK’s economic output in 15 years would be 8 per cent lower than if the country remained in the EU.

So it’s no wonder that resistance has been forming against the tough Brexit. A group of delegates – representing the Conservative Party – is calling for a parliamentary vote on whether the UK will remain in the Single Market or not. In other words, the delegates don’t want to accept the people’s vote and are insistent that Prime Minister May first needs parliamentary authorisation for her negotiations with the EU.

The currency markets responded quickly to May’s hard line on Brexit, causing the pound to fall even further (see chart):

Compared to the day of the Brexit vote, the pound has lost approximately 15 per cent against the euro and 16 per cent against the dollar. The British pound is currently valued at a lower rate than it’s seen in 31 years: 1.23 US dollars.

British stocks are booming

While the British currency plummets, its benchmark index, the British Pound based FTSE 100, is on its way to a new all-time high. At a good 7,100 points, the index is currently 12 per cent higher than on the day of the Brexit vote.

This might seem contradictory at first glance, yet this surge on the stock market ultimately reflects the savings that export-oriented British corporations are experiencing on the global market as a result of the weak pound – Brexit or not. This boom is further reinforced by the decision of the Bank of England to lower the base rates once again in response to the Brexit referendum.

More on the topic

Not so Different?: Dependency of the German and Italian Industry on China Intermediate Inputs

On average the German and Italian industry display a very similar intermediate input dependence on China, whether accounting for domestic inputs or not.

IW

China’s Trade Surplus – Implications for the World and for Europe

China’s merchandise trade surplus has reached an all-time high and is likely to rise further. A key driver appears to be a policy push to further bolster Chinese domestic manufacturing production, implying the danger of significant overcapacities.

IW