Although the euro zone’s debt crisis is far from over, the situation is unlikely to worsen dramatically. As the latest IW Crisis Monitor shows, all of the “crisis countries” are on the right path – except for Cyprus.

The “crisis countries” are on the right path

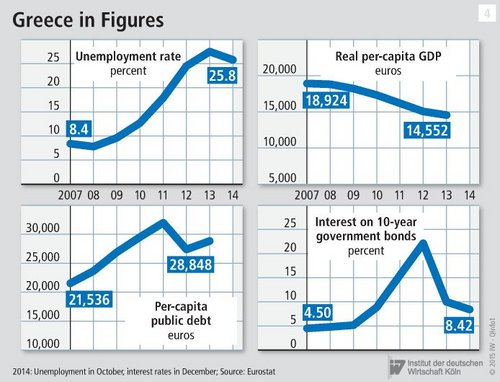

Europe is facing an uncertain situation in Greece, with the outcome and likely consequences yet to be determined. If Greece were to leave the euro zone, whether other countries would be susceptible to contagion would depend primarily on their economic strength. The Cologne Institute for Economic Research (IW) has created a Crisis Monitor to assess the risk of contagion and the likelihood that countries might find themselves dependent on financial aid, for example from the ESM rescue fund. To do so, it considers the four relevant indicators of a country’s economic strength: per-capita gross domestic product, unemployment rate, public debt and interest rates on government bonds. These four variables are weighted by their relative importance and combined to form a single score. The higher this score, the greater the potential for crisis.

The Crisis Monitor’s analysis shows that Portugal, Ireland and in particular Greece have made great progress (figure 4); in all three countries, scores have declined since 2012. All three have taken advantage of a financial assistance programme under the euro rescue plan, which Portugal and Ireland have already completed. The associated structural reforms are already showing an impact – budget deficits have declined dramatically, and labour and product markets have undergone considerable deregulation. As a result, these countries are once again experiencing growth.

In Cyprus, however, where a programme of financial assistance and reforms has been in place since the beginning of 2012, scores on the IW Crisis Monitor index have worsened each quarter. Spain is currently showing no movement. This is likely to change in the near future, however, since in Spain, too, there are signs that substantial progress in implementing reforms and a return to growth are on the horizon.

Yet despite these improvements, all of these countries are still in a critical range – which can be precisely defined by the IW Crisis Monitor (figure 3): All of the crisis-plagued countries first became dependent on financial assistance when their index scores were between -0.2 and +0.2. In other words, there is cause for concern when scores rise from the negative range to near zero.

Based on this yardstick, not only Greece, Ireland, Portugal, Spain and Cyprus are “crisis countries”, but Italy as well. Italy, the third-largest economy in the euro zone, first found itself in the Crisis Monitor’s critical range in 2012 and has remained there ever since. Its current index score is 0.05. France, the euro zone’s second-largest economy, also offers cause for concern. While its IW Crisis Monitor score was comparable to that of Germany in 2008, since that time it has steadily worsened to its current level of -0.28 – perilously close to the red line. The other large, economically strong countries are far removed from such a scenario. Both the Netherlands and Germany have a score of -0.6, while Sweden’s is an impressive -0.9.

More on the topic

Effects of Public Investment on Companies in Germany – Results of the IW Business Survey

Weak public investment activity in Germany has contributed to the low productivity growth of the last decades. Even maintaining the contribution to growth of state-owned capital stock at the already low level of the 1990s would have required an additional ...

IW

Reform of EU-fiscal rules: Lindner's ideas have merit

The German government's proposal to introduce a fixed limit on government spending growth for highly indebted member states in the course of the reform of the Stability and Growth Pact makes sense. Given the macroeconomic environment, such a minimum ...

IW