The Corona pandemic has led to increasing demands for the reshoring of pharmaceutical production back to Germany. A strategic dependence on non-European active ingredient and drug manufacturers is cited as an argument.

Where the German Pharmaceutical Industry Sources its Intermediate Inputs: An International Comparison

The Corona pandemic has led to increasing demands for the reshoring of pharmaceutical production back to Germany. A strategic dependence on non-European active ingredient and drug manufacturers is cited as an argument.

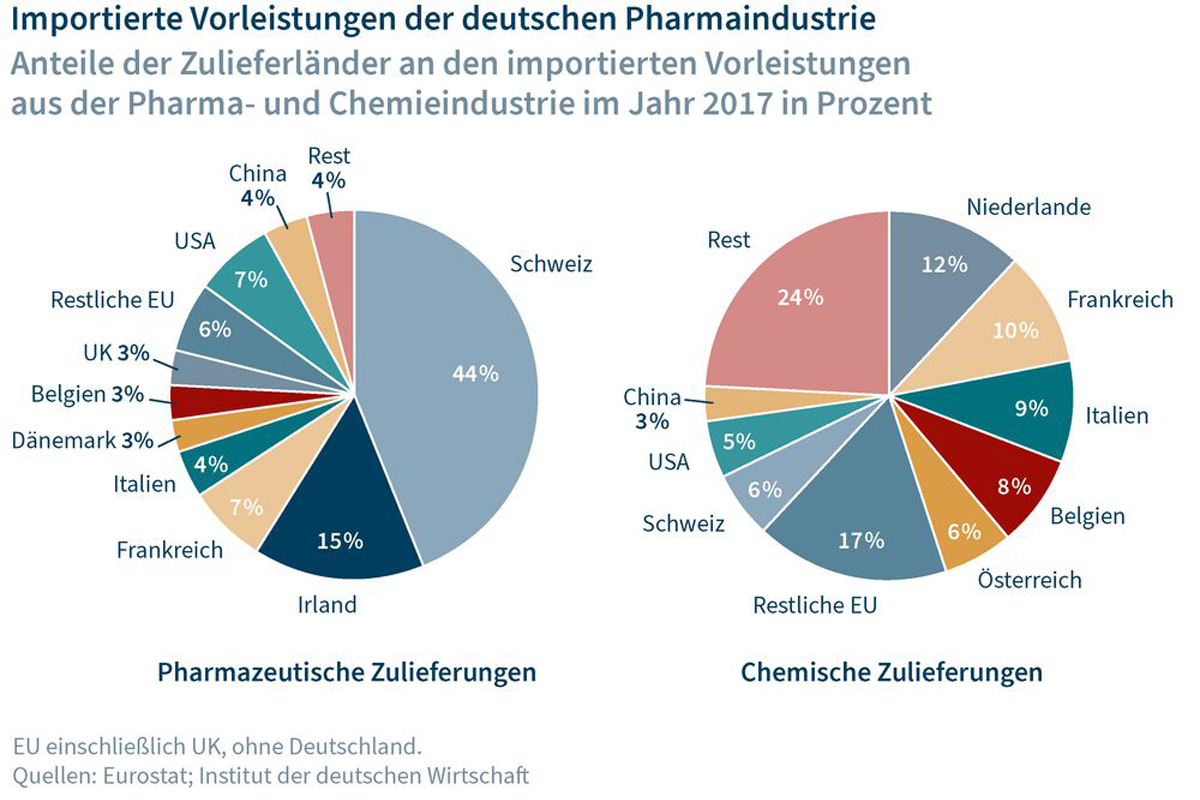

However, the German pharmaceutical industry sources most of its medicinal and chemical inputs either domestically or from other European countries. A similarly regional supply structure is to be found in the pharmaceutical and chemical sectors of those countries which supply the majority of intermediate inputs to Germany’s pharmaceutical industry, with those from China and India playing only a subordinate role. There is thus no evidence that German pharmaceutical production is predominantly dependent on these two Asian nations. However, since intermediate inputs are recorded by value, and prices for generic medicines and their active ingredients are much lower than those for innovative products, it is possible that despite China's small share of intermediate input purchases there may be a dependency in the case of certain individual generics. Nonetheless, a strategic boost to pharmaceutical production in Germany is scarcely to be achieved by expanding generic production. What is needed is rather a well-coordinated package of policy measures designed to encourage locally based firms to maintain and make long-term investments in their domestic production facilities and to promote the development of new innovative production. Such a course also pays off in terms of security of supply, since the patented innovative medicines of today are the generics of tomorrow.

Where the German Pharmaceutical Industry Sources its Intermediate Inputs: An International Comparison

More on the topic

A Macroeconomic Analysis of Wage-Price Spirals

The subject of this Analysis is the forms that wage-price spirals can take and how they influence macroeconomic stability and inflationary trends in Germany.

IW

Pharmaceutical industry: Increasing pressure on the labor market

The shortage of skilled workers poses significant challenges for pharmaceutical companies in Germany and is expected to become increasingly problematic in the context of demographic changes. Concerning Germany's positioning in the international competition ...

IW