The German Federal Financial Supervisory Authority (BaFin) is keeping a watchful eye on the granting of housing mortgages and from 2023 on will require lending banks to increase their equity capital to cover potential risks.

An Analysis of the Current Risk Levels in Residential Real Estate Financing in Germany

The German Federal Financial Supervisory Authority (BaFin) is keeping a watchful eye on the granting of housing mortgages and from 2023 on will require lending banks to increase their equity capital to cover potential risks.

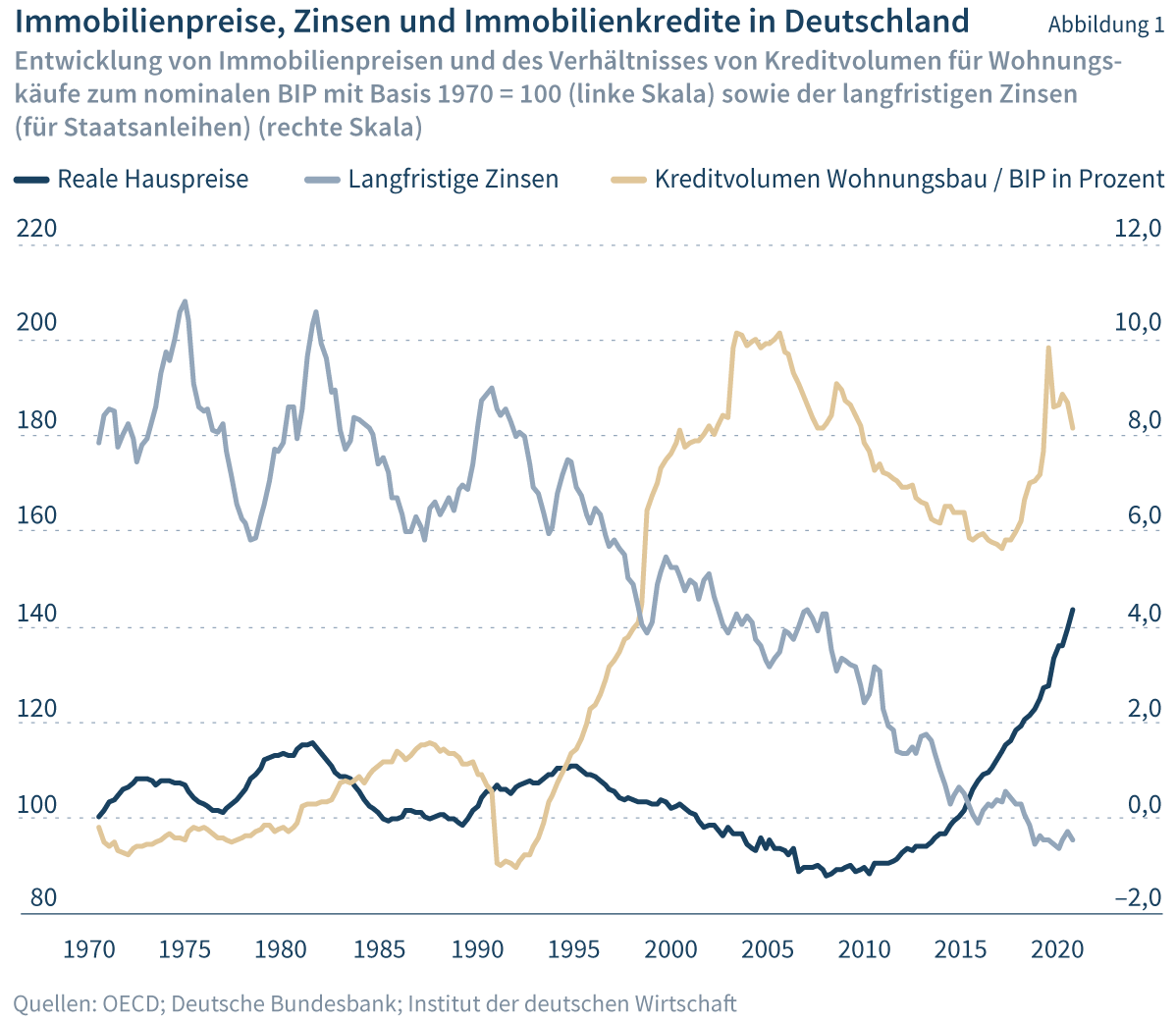

The present paper examines the extent to which the risks of lending to housing buyers have really increased by looking at how both overall credit volumes and the credit products themselves have developed. Although the total volume of housing loans has indeed risen, it has remained in line with expectations in comparison with other countries and with house price and interest rate movements. In previous years, lending had actually failed to grow as much as expected. While mortgages have tended to manifest higher loan-to-value ratios, amortisation rates have risen and interest rates have been fixed over longer periods. A risk analysis for follow-up financing shows that interest rate risks have increased over the years but are still relatively moderate. However, the proportion of loans with a loan-to-value ratio of more than 100 per cent is striking. In view of this, it is important that banks insist on an adequate minimum repayment rate. On the other hand, our study also highlights the gaps in the currently available data, which include neither the age of the borrowers nor any additional collateral.

An Analysis of the Current Risk Levels in Residential Real Estate Financing in Germany

More on the topic

Financialization in 13 cities – an international comparative report

Over the last 20 years, financialization of the housing market has become a topic of increasing public and political concern, especially in high-demand cities. It has also become an important element in academic discussion.

IW

A Hedonic Rental Price Index for Retail Properties in Germany

Despite their importance for users, investors and urban development, there is no appropriate monitoring of rent prices for retail properties in Germany. Comparing average rents alone is of limited benefit as the composition of location and quality properties ...

IW