By all appearances, the United Kingdom is going to leave the European Union. At this time, it is nearly impossible to predict what the institutional relationship between the two regions will be. This grave uncertainty is making itself felt particularly by British consumers and executives.

Brexit: High uncertainty, panicked moods and confident markets

By all appearances, the United Kingdom is going to leave the European Union. At this time, it is nearly impossible to predict what the institutional relationship between the two regions will be. This grave uncertainty is making itself felt particularly by British consumers and executives.

The negative vibes are being ignored by the stock markets: the British financial industry was punished, but large British corporations are altogether rated higher than they were before the referendum. With the exception of the finance industry, the market prices of German companies have also stabilised – after a significant drop.

Although Theresa May came out on top in the race for prime minister and promptly gathered her cabinet around her as early as the end of June, political uncertainty in the Kingdom is still at a worrying high. The Political Uncertainty Index quantifies this uncertainty, and currently finds it at a record high: more than five times as high as right after the terrorist attacks in September 2001 – the time period of historic destabilisation and skyrocketing share price losses. In Germany, the index is also showing a high not seen since indexing began in the early 1990’s – however, the level of measured uncertainty is only half as high as that in the UK (Economic Policy Uncertainty, 2016).

Both consumers and executives are showing uncertainty. In July, the GfK UK Consumer Confidence Index suffered its sharpest drop in over 20 years. Consumers in Germany, however, seem to be completely unfazed by the British confusion and are in great spending moods: consumer confidence has thus remained positive (GfK, 2016). A similar picture emerges when looking at executives’ moods. While German purchasing managers have been in constant good spirits since the referendum, their British counterparts’ moods have slumped rapidly: the British PMI experienced a ten-year low in July 2016 (Markit, 2016). The picture is thus clear: businesses and consumers expect a rapid downturn in economic performance in the United Kingdom, but expect little impact on the German economy.

This positive perception of the German economy is amazing considering that the British are the third largest consumers of German goods; the economic bond is strong. A possible recession in the UK would impact the export-based German economy in the intermediate term as well. The financial markets seem to have shared this view. On 24th June, the day after the Brexit referendum, the German stock index DAX lost a provisional ten percent. At the end of the day, the daily loss amounted to more than seven percent. Like its German counterpart, the British FTSE first lost almost ten percent of its value, but close of trading showed a loss of only three percent. The FTSE recovered from its losses in less than a week, but the DAX required over one month to do the same.

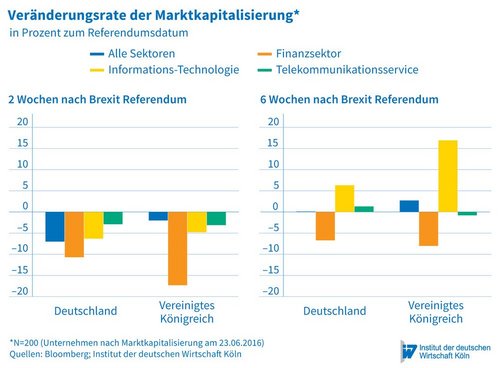

Because the benchmark indexes are not strictly comparable and do not reflect the economy as a whole, it makes sense to raise a change in market capitalisation – i.e. the total price for the purchase of all shares in a company – for each of the 200 most expensive companies listed on the stock markets in Germany and the United Kingdom. Again, a similar picture emerges as in the share indexes (see figure): After two weeks, German companies were seven percent cheaper than before the referendum; after 6 weeks they had just barely offset their losses. At this point, British companies were already three percent more expensive than before the referendum. Of course, Brexit was not the only significant event at the time. However, given the significance the referendum is currently being afforded by British economic actors, these stock market findings are really quite surprising: Germany was hit harder, in the short and medium term, in terms of share price and market capitalisation, than the United Kingdom. This was neither expected – nor can it be inferred from the real economy.

The industry breakdown shows that in both countries companies have lost value, in particular corporations in the finance industry. In the City of London, bankers fear losing access to important passporting rights – the right to the distribution of financial products in the European Economic Area. The complication of financial services exports would hit the British economy hard: about a quarter of the market capitalisation falls back to the financial industry. In addition, no other industry sells goods or services with nearly as high a value abroad. The abolition of the free movement of persons would be particularly difficult to compensate for in the sector: seven percent of EU citizens working in the UK are currently employed in the finance industry. It is thus understandable that market players assess the prospects for financial institutions as weaker than before the vote. Although the CEOs of major financial corporations are projecting calm (House of Commons, 2016), they represent the only sector that is still visibly in the minus as measured by the change in market capitalisation, six weeks on.

The performance of German banks has also fallen below average. However, this is not exclusively due to Brexit, but also to a large extent due to domestic problems. Taking the change in market capitalisation as a benchmark, the markets are – with the exception of the financial sector – astonishingly confident in terms of the development of the British economy compared to that of Germany. Considering however, the impacts of the adjusted Pound-Euro exchange rate, the value of UK companies loses, in contrast to the Eurozone, just under ten percent – the devaluation of the British pound. Measured in Euros, British companies are seven percent cheaper today than before the referendum.

Even such a loss in combination with relatively low market volatility testifies to the relaxation of the markets – considering that the Brexit result was heralded in various quarters as the end of the EU. Even if the stock markets are confident, one should keep in mind: it remains to be seen what will happen when the economic players’ devastatingly bad moods are reflected in the economic situation. Already – for example – there are signs of high degrees of restraint among those planning investments in the UK. Before investors take money in hand, they must first be clear which path the United Kingdom will take on its exit from the community of nations (Grömling / Huether, 2016).

Considering the large number of unanswered questions and unsettled treaties, it quickly becomes clear: the prevailing uncertainty could last much longer than just a few years (CER, 2016). The longer the process drags on, the more intensely restraints will be reflected in the real economy. This will also lead to a significant adjustment in the finance sector. This vicious cycle can only be broken if the government eventually gets a mandate to negotiate the UK’s remaining in the European Union. Until then, the British will have to brace themselves for an unclear market environment.

More on the topic

The Energy Dependence of Bank Loans

Russia's war against Ukraine has highlighted the vulnerability of the Federal Republic of Germany to Russian energy imports, especially natural gas.

IW

This time is different but still risky: Banking crisis instead of financial crisis

The current crisis of some American and European banks inevitably triggers fears that an international banking crisis could lead to a new financial crisis. But things in 2023 are very different from those in 2007.

IW