China is pressing ahead with its New Silk Road project. It has decided on large investments in other countries’ transportation infrastructure. China’s aim in this is to make access to the world markets more efficient while also promoting the development of its economically repressed provinces.

One Belt One Road: China’s new Silk Road

China is pressing ahead with its New Silk Road project. It has decided on large investments in other countries’ transportation infrastructure. China’s aim in this is to make access to the world markets more efficient while also promoting the development of its economically repressed provinces.

China is pushing forward with the concept of a New Silk Road. In Europe, we primarily associate the concept of the New Silk Road with new train connections to China; yet this is only one aspect of a much bigger plan. The One Belt, One Road (OBOR) project, which was first proposed in 2013, actually involves an attempt to create a sophisticated trade area in Eurasia – one that is intended to open new growth opportunities for China. The OBOR initiative connects two major programmes and comprises some 900 projects in 64 countries with an investment volume of 850 billion dollars (DVZ, 2016b, 3). Within the OBOR framework, China has signed agreements with 30 countries so far and has provided 60 billion dollars in multiple investment funds. The Asian Infrastructure Investment Bank (AIIB) with its start-up capital of 100 billion dollars was also launched in the context of OBOR.

21st Century Marine Silk Road – The sea route from China to Europe

Foreign trade statistics show that over 90 per cent of today’s trade with China are transported by ship. Sea transport is relatively slow (around 30 to 35 days, including pre-carriage and on-carriage), and yet it is very inexpensive. A forwarder currently spends less than 2,000 dollars for the transport of a large container (FEU) from China to Europe (DVZ, 2016c, 9). Shipping companies are, however, currently facing a crisis. Hanjin, a major shipping line, has already gone bankrupt. Still, sea transport will remain the backbone of world trade, which is why China’s OBOR activities also include investing heavily in Asian, African and European ports. This programme aims to connect additional regions to China’s sea route to Western Europe, thereby facilitating the export of Chinese products to these areas. The programme involves investments in ports that have been used very little up to now, such as Kenya’s Port Lamu – with the primary objective of creating logistical access to new markets. But there are also projects underway that are intended to improve efficiency along transport routes. One notable example is the major investment in the Port of Piraeus, which is set to be expanded into a logistical hub for the entire Mediterranean region (Putten/Meijinders, 2015, 9). If successful, this project would strongly impact the flow of transported goods in Europe, shifting trade traffic and logistics services from the ports in Northern Europe to those on the Mediterranean Sea.

Silk Road Economic Belt – Creating a Eurasian trade area

In Europe, OBOR is often perceived as a railway project. For some years now, freight trains have been rolling from China via Russia to Duisburg. The railway now has also established itself as an alternative means of transport to China. With a transport time of 20 to 25 hours (including pre-carriage and on-carriage), and transport costs between 4,000 and 6,000 dollars per FEU, rail transport has positioned itself as an inexpensive alternative to air freight in particular (DVZ, 2016a, 7). The ability of rail transport to compete with sea transport, however, is limited by capacities. After all, it would take up to 300 trains to replace a container ship. Still, China wants to make serious investments in land-based transport to its neighbouring countries. This programme is known as the Silk Road Economic Belt (SREB). As the name reveals, it involves more than creating a faster connection to Europe. Besides building up transport routes, the initiative is especially intended to boost growth in China’s neighbouring countries, making them more attractive trade partners for China. Major projects include the recently agreed upon construction of a transport link from western China to Pakistan’s Gwadar Port and the construction of a link that extends from China’s southwestern province of Yunnan to Calcutta via Myanmar and Bangladesh (BCIM). These two projects aim to connect China’s more remote provinces to the world trade routes, while also creating focal points for economic activity in the poor neighbouring countries. Both of these large undertakings also provide a link between the two OBOR project components.

OBOR: Why China wants to invest

OBOR represents a continuation of China’s infrastructure investment policy on an international level. China is not shouldering the high costs out of altruism, but because the investments promise to stimulate sustainable growth in the country’s own economy. The prosperity gains of the past 20 years are very unevenly distributed in China. In 2014, households in the coastal regions had an annual income of between 5,000 and 8,000 dollars (Statista, 2016). Figures were considerably worse for those in China’s western and northern provinces, which don’t have access to the sea. The good 350 million inhabitants of these provinces have to survive on an average annual household income of between 3,000 and 3,500 dollars. This is resulting in millions of itinerant labourers moving east, which is causing considerable social tensions.

The Chinese government has been trying to counteract this trend and to promote western development since the launch of the “Go West” strategy in 1999. However, the location of the western provinces places them at a disadvantage. Since trade with Europe and the United States is handled by ship, the goods from western China must first reach the ports in the eastern provinces to be loaded. This costs time and money, resulting in a less favourable assessment of such locations. Additionally, hinterland connections to seaports are chronically overloaded, leading to deadline risks. To resolve this problem, China is attempting to provide its western provinces with more convenient access to the sea trade routes. Such efforts include the projects in Pakistan and the BCIM.

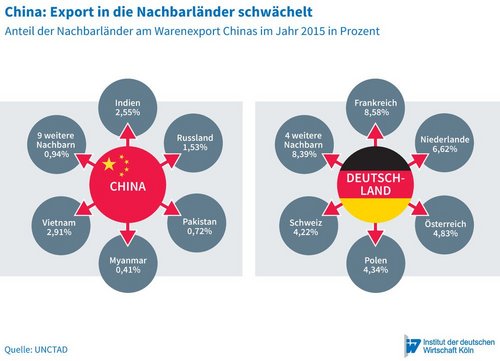

The planned land-based links towards the west are also intended to address another problem of the Chinese economy: its weak connections to the surrounding regions. Just over 9 per cent of China’s export goods go to its 14 neighbouring countries (see figure). In Germany, the corresponding figure is nearly 37 per cent. Even the large neighbouring countries of India and Russia only receive a combined total of 4 per cent of China’s export goods. The biggest export market among China’s neighbours is Vietnam, with a share of nearly 3 per cent. Yet this partner almost exclusively transacts business with provinces along the coast. The growth engine of regional trade with neighbours largely fails for China – and fails almost entirely for western China. In economic terms, the western provinces are generally isolated. The reasons for this include poverty on the other side of the border and the poor transport links. To strengthen the economy of the border regions sustainably, China is dependent on setting cross-border trade into motion. The SREB projects are primarily intended to serve this purpose. New links to Central Asia and the Persian Gulf will also provide better access to the energy resources from these regions.

All in all, OBOR constitutes an internationalisation of China’s investment policy up to now. The main objective is to generate growth for China.

More on the topic

Compendium 5.4: CO2 Regulation of Road Transport in Europe

With the Compendium CO2 Regulation in Europe, the IW has been providing the interested public with a comprehensive collection of data on the development of CO2 emissions from passenger car traffic in the European Union, as well as on the applicable regulatory ...

IW

The Transformation of the Automotive Industry: An International Comparison of Germany's Innovation Performance

The automotive industry is undergoing a comprehensive technological transformation that is challenging established value chains. Making sure that domestic research helps to shape this ongoing transformation is therefore an important task for countries with a ...

IW