The current Eurozone inflation data indicate that the European Central Bank’s (ECB) Quantitative Easing (QE) could not prevent deflation hazards until now. But expanding monetary policy measures like negative interest rates and restricting the use of physical cash would cause irreparable damage. These measures are in contrast to QE means of financial repression.

Monetary Policy between Deflation and Financial Repression

The current Eurozone inflation data indicate that the European Central Bank’s (ECB) Quantitative Easing (QE) could not prevent deflation hazards until now. But expanding monetary policy measures like negative interest rates and restricting the use of physical cash would cause irreparable damage. These measures are in contrast to QE means of financial repression.

Eurozone consumer prices fell in February 2016 by 0.2 percent in relation to February 2015 after they have risen in January 2016 by 0.3 percent. This triggered market expectations of a further monetary easing by the ECB in March 2016. New to the discussion on monetary policy are even deeper negative interest rates, restrictions on the use of physical cash as well as so-called helicopter money. Before the application of such severe measures, an analysis on their appropriateness as well as on their side-effects is necessary, because there are doubts on both.

Up to now it is questionable whether the current situation in the Eurozone is comparable to the one in March 2015 or the one in September 2015. While prices dropped in September 2015 for one month, they fell in March 2015 since four consecutive months. The situation in March made QE necessary, while the negative inflation rate in September was nothing more than white noise. Behind this background it is currently too early to doubt the effectiveness of QE and to demand further monetary policy actions.

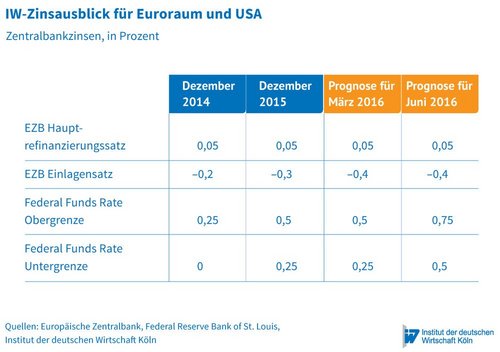

However, it can be expected that the ECB will loosen monetary policy because of the weak inflation expectations and possible business cycle risks. It will most likely cut the interest rate for banks to -0.4 percent. For the US can be expected that the Federal Reserve Bank will probably sit and wait in March and that it will increase its interest rates in June 2016 (see figure). The US labour market is still close to full-employment, but the decreasing oil price also calms the US inflation dynamics. In January 2016 the inflation rate was at 1.3 percent and thereby below the inflation target of 2 percent. But there are no threats from deflation for the US.

Some economists, e.g. Miles Kimball, call for negative interest rates to revive the economy (Agrawal/Kimball, 2015). In their logic, negative interest rates are comparable to conventional interest rate cuts. But this is not the case, because the negative interest rate contradicts the nature of a loan. A loan will be granted in the confidence of receiving 100 percent of the loan back in the future. A negative interest rate will be perceived by creditors as a partial default on the loan. Therefore, it can be assumed that the interest rate elasticities of investment and savings differ in the negative territory from those in a “normal” interest rate environment. Negative interest rates will therefore not run through the conventional transmission channels. Forecasts on the effectiveness of negative interest rates with historical data will lead to false conclusions.

The effectiveness of negative interest rates to stimulate the business cycle can be doubted. The possibility of negative interest rates on central bank deposits are just a consequence of central banks being monopolistic issuers of the monetary base with the monetary base being a non-redeemable central bank liability. In contrast to that, customer deposits are redeemable. Moreover, banks are competing on customer deposits, so they will set negative interest rates on their customers’ deposits only as an ultima ratio. Therefore, the negative interest rate will mostly shrink banks’ profits which will in times of scarce equity capital result in a reduction in bank lending.

But even in the case that banks could set a negative interest rate on customer deposits, one cannot expect a positive effect on the expenditures of companies and households:

- Companies would not increase their expenditures in order to circumvent negative interest rates, because their expenditures are determined by more decisive factors like the expected growth rate of the economy.

- The negative central bank rate should decrease the risk-free interest rate so that banks should finance investment projects which they had not financed under a higher risk-free rate. But it can be doubted that companies increase their loan demand in an environment with several downward corrections in growth expectations during the last years.

- Households would not increase their consumption expenditures and decrease their savings, since the necessity of old-age provisions depends on the difference between their life-expectancy and their retirement age. Negative interest rates will therefore only increase the costs of old-age provisions. A study reveals that in the cross-country average 17 percent of the surveyed households would increase their savings in response to negative interest rates. For the US the fraction of these households was 26 percent, for Austria 25 percent and for Germany 11 percent (Cliffe, 2016).

- The negative interest rate can not only be bypassed by hoarding cash, but also by investing in commodities or digital currencies, like Bitcoin. A flight of financial investors into commodities can decrease the supply for manufacturing firms, while a flight into digital currencies would undermine the acceptance of legal tenders because digital currencies can be stores of value as well as a means of payment.

- Negative interest rates may have effects in debtor countries, but not in creditor countries (Gros, 2016). Unsustainable debt levels should be addressed by the instruments of the insolvency law and not by financial repression.

- Investment is not weak because of too high interest rates but because of a lack of sufficient growth expectations as well as because of political uncertainty which can be inferred from indicators like the political uncertainty index.

Negative interest rates and the simultaneous political demands for an abatement of physical cash irritate market participants in times in which confidence into the currency is important. The abatement and even restrictions in the use of cash will cause an irreparable loss of confidence into politics and the currency.

In additions to that, there are increasing proposals on the use of helicopter money. Thereby money created by the central bank should either finance public investment or tax relieves. Helicopter money is in principle monetary financing and it is forbidden for at least the ECB. Every hyperinflation is indeed the result of a financing of sovereign budget deficits by the central bank. But one should not compare the emergence of a hyperinflation with the prevention of deflation. Because other than QE would helicopter money arouse desires from politics and it would restrict the independence of a central bank in fighting inflation.

The current deflationary hazards are caused by low oil prices and by weak investment demand with the later resulting from the yet unfinished balance sheet recession. Currently the economy does not lack monetary stimulus, but a lack of growth expectations. But those cannot be achieved by monetary policy alone.

More on the topic

Strengthened competition in payment services

Starting on January 13, 2018, the Second Payment Services Directive (PSD2) will apply in the European Union. Among other things, the Directive’s aim is to adapt regulation to the innovations in payment services and to promote the Single Market for non-cash ...

IW

An EU comparison: The structure of consumer spending

The purchasing power of EU consumers varies considerably. This is also reflected by the structure of households’ expenditure. The share of food in consumer spending is highest in Romania, one of the countries with the lowest per capita income. On the other ...

IW