Before the European Central Bank (ECB) becomes the supreme bank supervisor of the European Banking Union in November 2014, it will conduct a comprehensive assessment of the 128 largest system-relevant banks in the Eurozone. To prevent a further crisis of confidence if banks fail the stress test, the ECB should communicate strategies for any banks that do fail.

In the run: up to the Stress Test

The ECB will conduct its comprehensive assessment of Eurozone banks in three parts. First, it will evaluate the banks’ risks. Then, an in-depth analysis of the banks’ assets and securities (asset quality review) will follow. Finally, the ECB will evaluate the banks’ balance sheet strength under a pre-defined stress scenario such as a deep recession (stress test). In the last stress test conducted by the European Banking Authority (EBA) in 2011, banks which passed the stress test got into trouble later on, resulting in a loss of reputation for the EBA. Now it is up to the ECB to build its reputation as the supreme bank supervisor of the Eurozone and restore confidence in the European banking sector. Under a strict test, some banks will probably fail but so far the ECB has not communicated what will happen in this situation.

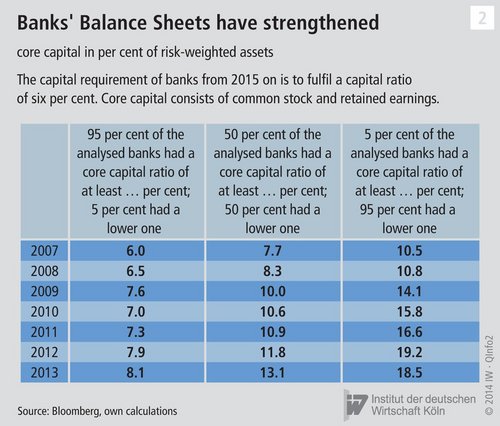

The current IW Bank Monitor contains an analysis of the stability of Eurozone banks. Balance sheet data reveals that banks have already strengthened their capital positions. In the third quarter of 2013, half of the banks had risk-based capital ratios of thirteen per cent or more while only five per cent had capital ratios of around eight per cent or less. It is an improvement on the pre-crisis period where banks had capital ratios of eight per cent on average (see table). The IW study finds that problems arise from non-performing loans in banks’ balance sheets. In 2012, non-performing loans amounted to €876 billion. The problem with these non-performing loans is that they accumulate in some financial institutions that are so large that their failure would cause a destabilisation of the Eurozone. Moreover, these banks are headquartered in the crisis countries and these countries will probably be pushed financially and economically to the limits by these failing banks.

An additional problem is that Eurozone banks are still over-exposed to sovereign debt, which makes them vulnerable to unsustainable high debt levels. Banks’ balance sheets worsen when ratings of sovereign debt deteriorate. Banks in trouble on the other side force sovereigns to rescue them with capital injections, which deteriorate the sovereign’s balance sheet. The European Banking Union is a major step in breaking this vicious circle. However, it is still in the start-up phase and the current stress test is due to occur before bank resolution instruments are fully ready for action. Moreover, the Eurozone is still in recovery from its deep recession and any news about additional bank problems will come at an inappropriate time.

However, conducting a less strict test would not solve this problem. Rather, it would worsen confidence because the public knows about the unsolved problems in Eurozone banks’ balance sheets.

A strict test will restore confidence in banking system stability only if its results trigger a restructuring or resolution of weak banks. In order to avoid uncertainty about how to cope with the resolution of one or more large and system-relevant banks, the ECB should only communicate test results alongside restructuring or resolution recommendations, where necessary. Restoring confidence will be a major step in solving the crisis in the Eurozone.

Demary, Markus, 2014, IW Bank Monitor: Will the European Central Bank’s Health Check for Banks Restore Confidence in the Eurozone?, IW Trends, Nr. 1-2014, Köln.

More on the topic

The Energy Dependence of Bank Loans

Russia's war against Ukraine has highlighted the vulnerability of the Federal Republic of Germany to Russian energy imports, especially natural gas.

IW

This time is different but still risky: Banking crisis instead of financial crisis

The current crisis of some American and European banks inevitably triggers fears that an international banking crisis could lead to a new financial crisis. But things in 2023 are very different from those in 2007.

IW