With the world economy showing signs of weakness, German companies have been exercising restraint in their investments. Once the economic environment bounces back, however, these companies will be well positioned for new investment activities – thanks to their robust financing structure.

Well positioned

Unlike the United States, where companies principally finance their activities through the capital markets, companies in Europe – and especially those in Germany – obtain their money through banks, by way of loans. They primarily use the capital market for the issue of shares.

Along with the high dependency on bank loans comes the risk that the more stringent regulations of the European finance sector could also hamper the activities of the real economy; this is especially true when companies have a harder time obtaining loans. There are three main factors that can help deduce whether or not German companies face this risk:

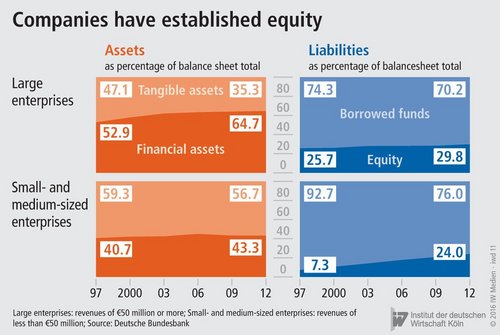

First is the ratio of equity to borrowed capital. Credit rating plays a major role in the loan approval process; and companies have improved their credit rating in recent years by establishing equity (see chart).

From 1997 to 2012, the equity ratio of large enterprises has increased by approximately four points to nearly 30 per cent; and in the case of small- and medium-sized enterprises, it increased by nearly 17 points to 24 per cent.

Equity mainly exists as financial assets and can thus be accessed easily for financing purposes. In large enterprises, the ratio of tangible assets to financial assets has shifted substantially. In 1997, nearly half of these companies’ assets consisted of material assets such as property and buildings; however, this figure dropped to 35 per cent by the year 2012. Conversely, financial assets – cash, accounts receivable and investments – increased from 53 to 65 per cent of the balance sheet total during the same period. In the small- and medium-sized enterprises, however, this trend is not nearly as pronounced.

Second is the ratio of capital market financing to bank financing. For German companies, financing by means of issuing bonds still plays only a secondary role. Short-term bonds with a term of up to three years constitute barely 0.1 per cent of GDP; likewise, long-term bonds amount to only 5.1 per cent of GDP.

In the case of long-term loans, the share of GDP is 31.9 per cent. While loans can be adjusted to the needs of the particular company, bonds tend to be more standardised.

Third is the ratio of short-term to long-term loans. Given the historically low interest rates, one would assume that companies might use the opportunity to replace short-term loans with long-term loans. But this isn’t the case. Indeed, the share of short-term loans in the balance sheet total has hardly changed since 1998, and the share of long-term loans has in fact dropped by a good four points to approximately 15 per cent. Instead, businesses are more frequently borrowing money at short notice from suppliers or from the company itself.

It’s not expected that companies will reinforce their capital market orientation – even if policymakers would like to see this happening.

More on the topic

Current account: Surplus is no ground for sanctions

The German economy is operating profitably in foreign trade. But contrary to popular belief, the current account surplus does not adversely affect the European countries impacted by the financial crisis. Indeed, the economic ascent of the newly industrialised ...

IW

German Energy turn-around – Energiewende: Electricity looking for storage

Battery storage could go mainstream with growing shares of power produced from wind and sun and electric cars becoming more common in the streets. A rapid growth of the role of rechargeable batteries would, however, also lead to a significantly higher demand ...

IW