The European monetary union still hasn’t prepared sufficient rules for cases where state insolvency is unavoidable. If this gap were closed, it would be easier to ensure that no euro area country will ever be liable for another euro area country’s debt. A recent proposal by Cologne-based IW illustrates a possible approach to an orderly insolvency procedures for euro area countries.

Drawn: out endings

The struggle over the future of Greece is continuing, and the out-come is uncertain. In the course of negotiations, the European Stability Mechanism (ESM), also known as the euro rescue fund, has been playing a major role. In recent years, the ESM has without a doubt contributed to supporting struggling euro area countries with the right mix of assistance and reform requirements so that they could overcome their crises.

However, the institutions of the monetary union have yet to find a systematic approach to mitigating the negative effects, if a country is bankrupt.

Against this backdrop, a systematic state insolvency process for the euro area is overdue. This notion is strengthened when bearing in mind that the risk of state bankruptcy is higher in a monetary union than it is for individual states which are independent in terms of their monetary policy. After all, independent states have the option of devaluating their debts by adopting an inflationary monetary policy.

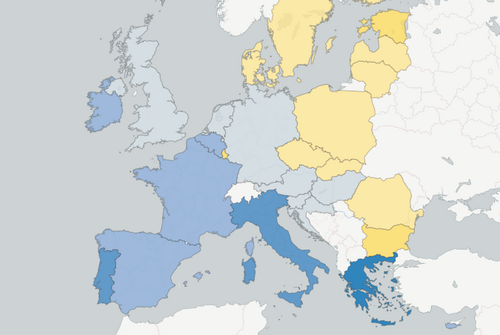

Furthermore, debt ratios in recent years have increased not just in the crisis countries, but also in many other EU member states (see diagram):

Source: European Commission 2015

Out of the 19 euro area countries, 13 have a debt ratio of more than 60 per cent of their gross domestic product (GDP). In six of these countries, government debts are now higher than their respective GDP.

As a result, it cannot be precluded that individual euro area countries could end up in a situation where they lose control over their debt. If there is no orderly procedure for dealing with this case, insolvency procedures could be delayed – meaning that the burden of debt would increase even more, which would eventually lead to more severe damage to the economy.

Against this backdrop, the Cologne Institute for Economic Research (IW) proposes a state insolvency mechanism based on combining and adapting existing concepts. The details:

- Decision on state insolvency procedures. The overindebted state itself would normally initiate the procedures, for example if sharply increasing interest rates render it difficult or impossible to obtain new loans.

To avoid delays, however, in exceptional cases and as ultima ratio the ESM should equally be able to initiate such procedures on the basis of a very large majority of ESM voting rights. A further precondition for the starting the insolvency procedure would be that the EU Commission, the European Central Bank and the International Monetary Fund conclude a a debt sustainability analysis with a negative outcome. So far, it has not been stated with sufficient claritythat an insolvency procedure must be initiated in such a case. Thus, the ESM treaty needs to be amended accordingly.

If, however, the country in crisis is deemed capable of sustaining its sovereign debt, the IW proposal suggests to stick to the rule that the ESM provides liquidity support for a duration of three years. However, as requested by the Deutsche Bundesbank, the state should defer debt repayments to private creditors for the time of the ESM programme in order to avoid that private debt is simply replaced by public debt. If the rescue and reform programme does not prove successful, an insolvency procedures should become obligatory which also requires an amendment to the ESM treaty.

- State insolvency procedures. In order for insolvency procedures to be reliable and effective, the IW proposes a negotiation process between the debtor country and its creditors, encompassing a number of steps, each of which would have a fixed deadline.

As a first step, the debtor country itself should attempt to find a freely negotiated solution with its creditors. If no solution is found, the second step would involve a legal body, located as a new chamber at the Court of Justice of the EU, which would support negotiations by providing a framework with rules, a code of conduct and with legal and economic advice. If again no agreed solution is found, this body could take an ultima ratio binding decision on the conditions of the debt restructuring.

This option of a binding decision is intended to increase the pressure on the negotiating parties to find a solution. Similarly, an effective negotiation framework is needed to cope with the problem of so-called holdout investors that refuse to agree on a debt restructuring and assert their claims in court – at the expense of the state and the consenting creditors. As an additional measure to contain holdout strategies, it should be ensured that a qualified overall majority of creditors can bind a dissenting minority. To this aim, so called collective action clauses in sovereign bonds of euro area countries have to be changed accordingly.

As an additional element of the IW’s proposal, ESM financial support is foreseen. During the negotiations about the debt restructuring the indebted country is usually cut off from financial markets and therefore suffers from a severe financial and economic crisis. ESM bridge financing – together with a moratorium on debt service and a stay on litigation and enforcement - would allow the state in question to sustain basic government functions, such as police forces or teachers. However, strict requirements for reform and constructive cooperation have to be attached to the financial support facility.

- Benefits of state insolvency procedures. The proposed approach supports a basic principle of the European monetary union, that no euro area country should be liable for another member country’s sovereign debt. This approach should encourage financial markets, to require higher interest rates if government debts increase significantly. This in turn could serve as an incentive for sound fiscal policy.

Furthermore, this approach would prevent euro area countries from endlessly receiving ESM loans, even if they repeatedly violate the rules of the monetary union.

Overall, it would clearly make sense to decide in favour of an orderly and reliable insolvency procedure for sovereign states soon. However, such a mechanism can only be implemented in the medium term, once a number of preconditions have been met:

Apart from the necessity to demonstrate that euro area countries can reliably lower their high government debt levels, the euro area banks would need to be able to cope with losses arising from the insolvency of a member state. To this aim, banks need to be better capitalised and sovereign bonds of euro area countries must no longer be considered risk-free in banking regulation.

To reduce the excessive exposures of many banks to sovereign bonds, especially of their own state, the ECB as the single supervisor should induce overexposed banks to sell the respective bonds to the ECB as part of the current public sector purchase program.

The only way is up

Government debts in percent of GDP since 1991, starting with the most indebted European country in 2014

More on the topic

Not so Different?: Dependency of the German and Italian Industry on China Intermediate Inputs

On average the German and Italian industry display a very similar intermediate input dependence on China, whether accounting for domestic inputs or not.

IW

China’s Trade Surplus – Implications for the World and for Europe

China’s merchandise trade surplus has reached an all-time high and is likely to rise further. A key driver appears to be a policy push to further bolster Chinese domestic manufacturing production, implying the danger of significant overcapacities.

IW