In the debate on the possibility of Greece leaving the Eurozone, it has repeatedly been argued that a Grexit would have economic consequences for Germany, too. In fact, no negative real economic effects are to be expected, or at least none worth mentioning.

The collateral damage remains slight

All over the country, in talk-shows, in editorials and in academic circles, the burning question is: what financial and real economic consequences would a Grexit have for Germany?

Fiscal consequences. Nobody can say today exactly how much a Greek bankruptcy would ultimately cost the German taxpayer. German guarantees for the rescue fund alone total almost 40 billion euros, while claims arising from the payment transactions of the central banks (TARGET II, cf. iwd 16/2014) amount to roughly 30 billion euros.

However, until the full extent of possible debt relief and the detailed arrangements for the European Central Bank’s write-off are known, the 87-billion-euro loss which Germany is said to be facing is pure speculation.

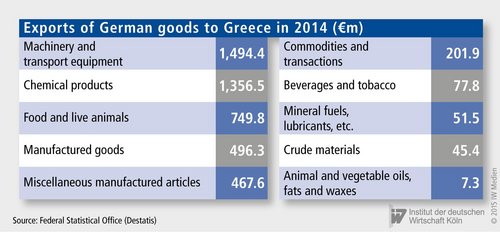

Real economic consequences. Here it is possible to be a little more exact about what a Grexit would mean for Germany as an exporting nation. There are two good reasons why a meltdown can be discounted. Firstly, the danger of other euro countries being infected by Greece’s insolvency is currently quite low. In contrast to the situation some years ago, there is thus no great likelihood that German exports to Spain or Italy, for example, will plummet. Secondly, there is no especially dense web of trade links between Germany and Greece (see chart):

Since the finance and economic crisis of 2008 and 2009 exports of German goods to Greece have slumped by almost 40 per cent.

This is despite the fact that total exports of German goods have increased by more than 15 per cent over the same period. Expressed in euros, this means that between 2008 and 2014 exports of goods to Greece fell from almost 8 billion euros to just under 5 billion euros.

This development has affected the machinery, electrical engineering and automotive industries particularly severely, with exports by these three metalworking and electrical sectors falling from 3.4 to 1.5 billion euros. Exports of chemical products and of food have remained more or less stable.

Compared with total exports of currently 1.1 billions euros, deliveries to Greece are not of great significance, however. Their share of all German exports is 0.4 per cent, down from 0.8 per cent in 2008. The essential adjustment in the export of manufactured products has thus already taken place.

More on the topic

Not so Different?: Dependency of the German and Italian Industry on China Intermediate Inputs

On average the German and Italian industry display a very similar intermediate input dependence on China, whether accounting for domestic inputs or not.

IW

China’s Trade Surplus – Implications for the World and for Europe

China’s merchandise trade surplus has reached an all-time high and is likely to rise further. A key driver appears to be a policy push to further bolster Chinese domestic manufacturing production, implying the danger of significant overcapacities.

IW