No other country has signed as many free trade agreements as Mexico. The country has also had a “Global Agreement” in place with the EU for the past 15 years, which is now facing a possible update.

World champion in free trade

Even if TTIP negotiations are dragging on, the European Commission is pressing ahead with the “Trade for All” strategy it announced last year. This strategy includes revisions to existing agreements.

And that’s exactly what’s happening with the agreement between Mexico and Europe. The new agreement is intended to improve market access for goods, services and investments; for instance, Mexico is pushing for export relief on agricultural products such as bananas and avocados and on tuna. The agenda also includes such items as sustainable development, better protection for intellectual property rights and the elimination of trade barriers.

The EU is Mexico’s third most important economic partner, after the United States and China; and when it comes to exports, the EU is Mexico’s second-largest market. Some of the strongest trade relations are those between Mexico and Germany:

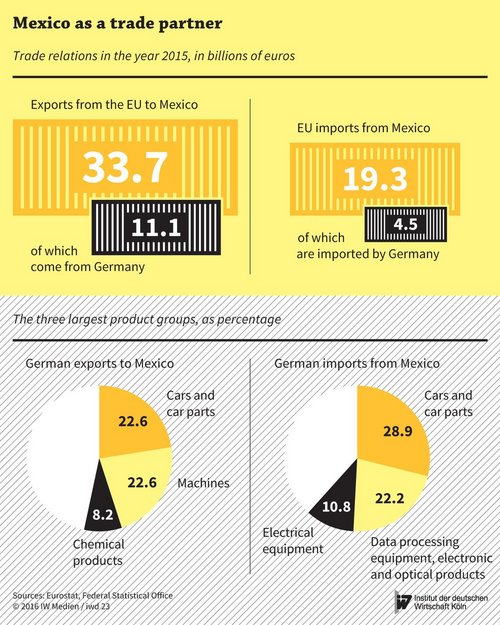

Germany is the EU’s largest buyer of Mexican products; and conversely, Germany is by far the largest EU supplier of goods to Mexico.

Approximately one-third of the EU’s exports to Mexico come from Germany (see chart). In the year 2015, Germany and Mexico exchanged goods with a total value of 15.6 billion euros. In particular demand are products from Germany’s mechanical engineering and automotive sectors.

Yet Mexico, as the second-largest economy in Latin America, is itself a key strategic location for the German automotive industry. VW has been manufacturing vehicles in Mexico for decades, and three other German car manufacturers are also planning to set up production sites there. Foreign companies with manufacturing facilities in Mexico are especially keen to see the country follow a consistent free trade policy. Mexico is party to eleven free trade agreements with a total of 46 countries. Add to this the Trans-Pacific Partnership, which, once it has entered into force, will enable Mexican-based companies to export their goods – with reduced or eliminated tariffs – into more countries than from any other location in the world.

More on the topic

Not so Different?: Dependency of the German and Italian Industry on China Intermediate Inputs

On average the German and Italian industry display a very similar intermediate input dependence on China, whether accounting for domestic inputs or not.

IW

China’s Trade Surplus – Implications for the World and for Europe

China’s merchandise trade surplus has reached an all-time high and is likely to rise further. A key driver appears to be a policy push to further bolster Chinese domestic manufacturing production, implying the danger of significant overcapacities.

IW