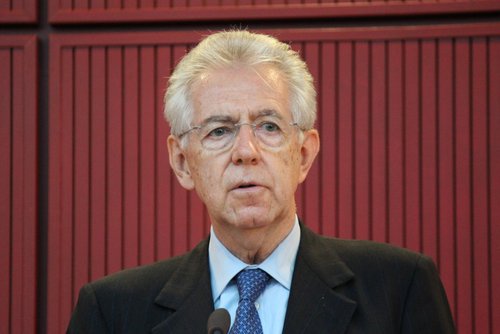

The European Union is funding its budget mainly through contributions from its Member States. This could change: Italy's former Prime Minister Mario Monti suggests that the EU should collect its own taxes in the future. But that would not be a good idea.

No taxes for Europe

On Friday, the ECOFIN Council will discuss the report that the High Level Group of Experts, chaired by Mario Monti, has recently published. There is, in any case, a need for action: the Union's current financing system needs to be simplified. In addition, the United Kingdom, a large net contributor, will leave the EU.

EU taxation is not an alternative, however. As long as the EU budget is financed mainly through contributions from the Member States, national governments have an interest in an economically effective distribution of EU funds. The introduction of a European tax would weaken this interest, as EU revenues would flow directly into the Brussels budget. There is only an incentive to redeploy and reprioritize funding and finance projects which are of rising interest to the whole of Europe, when the EU budget restriction meets the fiscal interest of the Member States. Projects of rising interest are a common foreign and security policy and a common refugee policy.

At the moment, the EU's annual budget consists mainly of three sources: the first one is the EU’s single own source of income, namely revenues from customs duties levied on the import of goods from third countries into the single market; the second source is the national contributions which are based on the value added tax (VAT) and are paid by the Member States to the Brussels budget; and the largest share of the budget stems from contributions paid by the Member States to the EU according to their gross national income (GNI). Last year, GNI contributions accounted for almost EUR 104 bn, with an EU budget of EUR 143.5 bn.

A reform of the EU funding should abolish the contributions based on the VAT. The EU budget should only be based on the revenues from customs duties and the GNI contributions. The latter have the great advantage that they follow the economic performance of an economy.

More on the topic

Not so Different?: Dependency of the German and Italian Industry on China Intermediate Inputs

On average the German and Italian industry display a very similar intermediate input dependence on China, whether accounting for domestic inputs or not.

IW

China’s Trade Surplus – Implications for the World and for Europe

China’s merchandise trade surplus has reached an all-time high and is likely to rise further. A key driver appears to be a policy push to further bolster Chinese domestic manufacturing production, implying the danger of significant overcapacities.

IW